The CDMA Development Group (CDG) and the Third Generation Partnership Project 2 (3GPP2) has recently released their proposed Ultra Mobile Broadband (UMB) standard, the technology they hope will trump the mobile iterations of IEEE 802.16e-2005 (so-called mobile WiMAX) and Long-Term Evolution (LTE) as the world's eventual 4G standard.

The proposal now needs to undergo final standardization, which backers predict will be a rapid process. In the United States, UMB is scheduled to emerge as Telecommunications Industry Association (TIA) standard TIA-1121.

The UMB proposal is an Orthogonal Frequency Division Multiple Access (OFDMA) solution that uses

- "sophisticated" control and signaling mechanisms;

- radio resource management (RRM);

- adaptive reverse link (RL) interference management; and

- such advanced antenna techniques as Multiple Input Multiple Output (MIMO), Space Division Multiple Access (SDMA) and beamforming.

It supports inter-technology handoffs and seamless operation with existing CDMA2000 1X and 1xEV-DO systems. It claims to be able to deliver both high-capacity voice and broadband data in all environments, including fixed, pedestrian and fully mobile in excess of 300 km/hr. It supports, proponents say, as many as 1,000 simultaneous VoIP users within a single sector, using 20 megahertz of bandwidth. Average latency is 14.3 mSec over-the-air to support VoIP, push-to-talk and other delay-sensitive applications with minimal jitter.

The unveiling of the UMB proposal, an IP-based mobile broadband standard alleged to enable peak download data rates of 288 Mb/s in a 20-megahertz bandwidth, is clearly evidence that a 4G technology potentially four times as fast as mobile WiMAX is almost market-ready. The CDG and 3GPP2 estimate initial commercial availability at the first half of 2009, and they clearly hope to convince carriers looking at 802.16 to instead wait just a little longer what the CDG fancies is a technology that will "leapfrog other wireless broadband technologies to become the leading standard adopted for next generation mobile telecommunications."

And, of course, all the players - including UMB, LTE and the mobile WiMAX camp - are in a death match for designation as the official definition of wireless 4G technology. That definition won't be released until the 2008/09 timeframe, in the form of the International Telecommunication Union's (ITU) IMT-Advanced requirements. However, some folks, like those at research house In-Stat, also think initial implementations of LTE, UMB and 802.16 WiMAX may fall short of throughput and other expectations, with later enhancements or even some type of technology combination actually bringing real 4G to the table But that's not what the corporate backers of each of the technologies really wants (Qualcomm is behind UMB, which it considers a member of the CDMA 2000 family; Ericsson is touting LTE; and Intel has spent uncounted millions singing the glories of WiMAX). Each wants its technology to be "the one" - thus the faster the push to get UMB at least certified as a TIA standard before the ITU acts, the better to compete with the fact there is an IEEE designation for the foundation technology behind what is being called WiMAX (without, interestingly, the official permission of the IEEE).

"It is expected that the UMB specification will be quickly converted into an official global standard by the 3GPP2 organizational partners," the 3GPP2 said in its statement unveiling the final UMB proposal. It also noted that those "organization partners" include the Association of Radio Industries and Businesses (ARIB) in Japan, China Communications Standards Association (CCSA), TIA in North America, the Telecommunications Technology Association (TTA) in South Korea and the Telecommunications Technology Committee (TTC) in Japan.

Keep pace with the latest and most recent news and updates in telecom, broadcasting and IT sector

Enterprise Segment - The new mantra for Telecom equipment vendors & service providers

Every Vendor in Hardware/software Telecom space is eying at Enterprise segment. The offerings are based on variety of hardware and software platforms. Here are few examples -

- Cisco has recentlyunveiled a new line of hardware and software in its "Empowered Branch" portfolio, building on the offerings it already has that are designed to give branches essentially the same type of service as corporate headquarters.

The latest gear even extends to tiny offices with fewer than 20 workers.

The new offerings include the first "lite" version of Cisco's flagship IOS software, hardware that includes routers and LAN switches, and new support for 802.11n wireless. With the emergence of new business applications and a more collaborative global business environment, Cisco customers are putting a greater emphasis on their remote offices. Cisco Empowered Branch allows them to take advantage of new business opportunities by providing them with a network platform that addresses all their application and service needs today, yet continuously evolves to provide service innovations required for the future.

- The International Association of Managed Service Providers, better known as the MSPAlliance, has launched a Vendor Accreditation Program (VAP) for the managed-services industry and named the first seven vendors certified under that program.

Those first seven are Intel, SilverBack Technologies/Dell, Asigra, Untangle, XRoads Networks, LiveCargo and N-Able Technologies.

The Alliance, which claims membership of some 2,000 managed-service providers (MSPs), already has been accrediting MSPs, but this is the first time it's accredited the suppliers that provide systems and software to those MSPs. The group wants to grow the first seven accredited vendors quickly to a group of at least 50.

- BT Conferencing, the conferencing and collaboration services division of BT, entered into a strategic partnership with the Corporate Executive Board to provide global collaborative services for the next three years to the Board's enterprise clientele.

As part of the agreement, BT Conferencing will provide Corporate Executive Board with managed audio and Web services to its network of more than 14,000 C-suite executives and their staff from more than 3,700 leading global corporations and organizations, including much of the Fortune 500. Implementation of the new service already has begun, and it should be in full swing by the end of the week.

BT Conferencing has offices in the United States, EMEA and Asia Pacific; it specializes in delivering conferencing and collaborative solutions and product hardware to some of the largest companies in the world, and its solutions are designed for enterprises a million minutes or more of conferencing time. The Corporate Executive Board Company provides best-practices research and analysis focusing on corporate strategy, operations and general management issues.

- In North America and Western Europe, large companies will play an increasing role in VoIP adoption, says ABI Research, adding hosted services will be used on a more regular basis as well, becoming a stronger engine for enterprise VoIP growth in the future.

The hosted services market for VoIP applications initially focused on (and found success with) smaller companies, the research firm says. Typically, smaller companies do not have the IT staff or the budget to install their own VoIP systems. As a result, they often rely on service providers for VoIP services that include the type of features found in large-enterprise phone networks. Service providers have not focused on large-enterprise-hosted phone services, but this is likely to change in the future as telecom operators (i.e., the traditional market leaders) face new competition in the smaller-business market from competitive operators, cable operators and other alternative-service providers. ABI Research believes service providers will take their experience with easy-to-serve small companies to adaptively re-size to favor larger companies.

The news from all quarters on enterprise telecom business and solutions are pouring in from all quarters. In India also the market is already estimated to be sized at Rs 10,000 cr pa and is growing fast. The success of telecom operators in this segment will depend not on an early move but on the right move. The one who can mix the right technologies with the best service level agreements will emerge as winner

- Cisco has recentlyunveiled a new line of hardware and software in its "Empowered Branch" portfolio, building on the offerings it already has that are designed to give branches essentially the same type of service as corporate headquarters.

The latest gear even extends to tiny offices with fewer than 20 workers.

The new offerings include the first "lite" version of Cisco's flagship IOS software, hardware that includes routers and LAN switches, and new support for 802.11n wireless. With the emergence of new business applications and a more collaborative global business environment, Cisco customers are putting a greater emphasis on their remote offices. Cisco Empowered Branch allows them to take advantage of new business opportunities by providing them with a network platform that addresses all their application and service needs today, yet continuously evolves to provide service innovations required for the future.

- The International Association of Managed Service Providers, better known as the MSPAlliance, has launched a Vendor Accreditation Program (VAP) for the managed-services industry and named the first seven vendors certified under that program.

Those first seven are Intel, SilverBack Technologies/Dell, Asigra, Untangle, XRoads Networks, LiveCargo and N-Able Technologies.

The Alliance, which claims membership of some 2,000 managed-service providers (MSPs), already has been accrediting MSPs, but this is the first time it's accredited the suppliers that provide systems and software to those MSPs. The group wants to grow the first seven accredited vendors quickly to a group of at least 50.

- BT Conferencing, the conferencing and collaboration services division of BT, entered into a strategic partnership with the Corporate Executive Board to provide global collaborative services for the next three years to the Board's enterprise clientele.

As part of the agreement, BT Conferencing will provide Corporate Executive Board with managed audio and Web services to its network of more than 14,000 C-suite executives and their staff from more than 3,700 leading global corporations and organizations, including much of the Fortune 500. Implementation of the new service already has begun, and it should be in full swing by the end of the week.

BT Conferencing has offices in the United States, EMEA and Asia Pacific; it specializes in delivering conferencing and collaborative solutions and product hardware to some of the largest companies in the world, and its solutions are designed for enterprises a million minutes or more of conferencing time. The Corporate Executive Board Company provides best-practices research and analysis focusing on corporate strategy, operations and general management issues.

- In North America and Western Europe, large companies will play an increasing role in VoIP adoption, says ABI Research, adding hosted services will be used on a more regular basis as well, becoming a stronger engine for enterprise VoIP growth in the future.

The hosted services market for VoIP applications initially focused on (and found success with) smaller companies, the research firm says. Typically, smaller companies do not have the IT staff or the budget to install their own VoIP systems. As a result, they often rely on service providers for VoIP services that include the type of features found in large-enterprise phone networks. Service providers have not focused on large-enterprise-hosted phone services, but this is likely to change in the future as telecom operators (i.e., the traditional market leaders) face new competition in the smaller-business market from competitive operators, cable operators and other alternative-service providers. ABI Research believes service providers will take their experience with easy-to-serve small companies to adaptively re-size to favor larger companies.

The news from all quarters on enterprise telecom business and solutions are pouring in from all quarters. In India also the market is already estimated to be sized at Rs 10,000 cr pa and is growing fast. The success of telecom operators in this segment will depend not on an early move but on the right move. The one who can mix the right technologies with the best service level agreements will emerge as winner

US Treasury to get next-generation enterprise network - Similar large enterprise business opportunities to crop up in India soon

Came across the following news item. My comments are at the end.

AT&T has picked up what could amount to a $1 billion order to build a next-generation enterprise network for the U.S. Treasury. The award is the first of what eventually will be dozens of billions of dollars spent by the U.S. government under the Networx Universal contract, the largest single telecom order in the history of the world, shared by teams led by AT&T, Verizon and Quest.

Under the Treasury order, AT&T and members of its team are to build and transition the Treasury to a next-gen enterprise network known as the Treasury Network (TNet). Technically, the award is for $270 million but, with various add-ons and options, it's expected to hit $1 billion. What the Treasury has ordered is a fully managed network service, coupled with service-level agreements and performance incentives to deliver secure voice, data and video communications.

The Networx contract actually represents a reiteration of a $1 billion, 10-year contract Treasury had awarded AT&T in December 2004. That award was the following year, following protests upheld by the GSA. Initially, it had been thought Treasury would re-bid the contract itself but, as it now turns out, it's now under the Networx umbrella.

In India also many of the state government treasuries have built their networks at the cost of millions of rupees. Govt. of M.P., Karnataka etc have been leaders in this respect. The next wave of upgrading these networks to next -generation manages service networks is expected soon and will be a big business opportunity for Indian Telcos

AT&T has picked up what could amount to a $1 billion order to build a next-generation enterprise network for the U.S. Treasury. The award is the first of what eventually will be dozens of billions of dollars spent by the U.S. government under the Networx Universal contract, the largest single telecom order in the history of the world, shared by teams led by AT&T, Verizon and Quest.

Under the Treasury order, AT&T and members of its team are to build and transition the Treasury to a next-gen enterprise network known as the Treasury Network (TNet). Technically, the award is for $270 million but, with various add-ons and options, it's expected to hit $1 billion. What the Treasury has ordered is a fully managed network service, coupled with service-level agreements and performance incentives to deliver secure voice, data and video communications.

The Networx contract actually represents a reiteration of a $1 billion, 10-year contract Treasury had awarded AT&T in December 2004. That award was the following year, following protests upheld by the GSA. Initially, it had been thought Treasury would re-bid the contract itself but, as it now turns out, it's now under the Networx umbrella.

In India also many of the state government treasuries have built their networks at the cost of millions of rupees. Govt. of M.P., Karnataka etc have been leaders in this respect. The next wave of upgrading these networks to next -generation manages service networks is expected soon and will be a big business opportunity for Indian Telcos

A case for implementing number portability in India

Well friends the debate on implementation of number portability in India is now almost 3 years old. The issue keeps popping up every time TRAI comes out with some statements. Here are the extracts of my arguments in favor of implementing the same. These were presented at a debate at IIM Bangalore. I have covered them in a post earlier , but am repeating them in view of the currency of the issue. I welcome your comments on the same. -

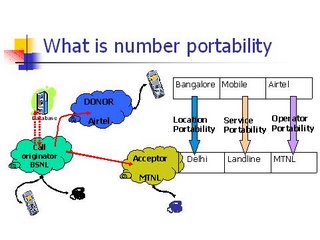

What is number portability (NP)?

Number Portability

allows subscriber to change their service provider to one having –

the best service quality

lower tariff options,

& better network coverage

while retaining their old telephone number.

Technological reasons for implementing

Arguments against implementation - India not yet ready as Implementation requires large technological changes;

My Argument why it should be implemented

Our Mobile network is state of the art; technically much better than many countries where MNP is already working

We introduced many services ahead of even developing countries e.g. GPRS

Fixed line NP may have problems; can be sorted and taken up in next stage

If it can work in S Korea – 2004; Greece – 2004; Lithuania – 2005; Belgium – 2000; Honk Kong - 1998

why not in India

Arguments against implementation - India not yet ready as Our tele-density is still much below developed countries; We should concentrate on increasing tele-density; We have enough operators for competition

My Argument why it should be implemented

Mobile nos. in India are largely in Urban areas. Our urban tele-density is ~40.

We added almost 18m mobiles in last 3 months. That means urban teledensity has increased over 6 in last three months.

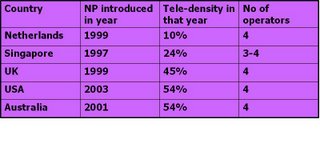

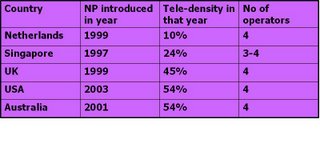

Requires 12-18 months in implementation after decision. Urban tele-density may cross 50 by then. following table indicate that we will be at par or better than developed countries in terms of tele-density for implementing Number Portability(NP)

For one service say GSM mobile we have maximum 4 operators per service area

Economic reasons

Arguments against implementation - Implementation require huge initial investments, which will outweigh the benefits. Rather we should Concentrate on improving service quality

My Argument why it should be implemented

Its exactly the service quality for which we need NP

Today India has one of the lowest rates for mobile services but quality of service offered is poor

NP eliminates pseudo and psychological barriers to churning thus providing truly competitive market and service quality improvement

Some estimate costs as high as 5000 Cr for implementation which are amplified and incorrect estimate even for implementing full fledged NP across services, operators & Locations

Implement just Mobile NP, then go for fixed line

Call forwarding technology does not requires much costs

Even other technologies for mobile number portability we require central database, routing and query arrangements. It will not cost more than 150 cr to implement.

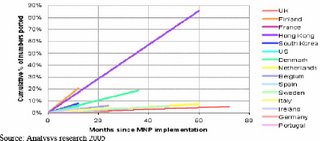

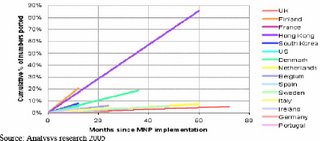

India has 85m mobile connection now. By 2007 they will be more than 150m. Even if 10% use NP we have 15m users. (Spain 3m used.); International Data Corporation India conducted a survey and found that “30% of mobile subscribers are likely to shift to an operator offering better service, if given the option.” Internationally 10% churning of numbers with NP is common as shown in following figure-

Charge of Just Rs 200 can cover costs. Internationally average charges are around 12-14$.

If consumer is ready to pay for better service and availing better tariffs, why it should not be implemented

Operational reasons

Arguments against implementation - Implementation will have problems of distortions by donor networks

My Argument why it should be implemented

Good planning and proper regulations on following issues can help in smooth operations –

Go for all India implementation

Don’t go for call forwarding option

Locking of handsets to be banned

Address lock in period problems

Costs to be collected and born by recipient networks

Operational problems can always be sorted out in time. After all India is not the first country to implement the NP

Conclusion

The US Supreme Court has directed adoption of number portability and India should also follow. The department of telecommunications (DoT) has set April, 2007 as the deadline for the implementation of mobile phone number portability. The deadline had been recommended by the Telecom Regulatory Authority of India (Trai) and submitted to the DoT in March '06

India is well prepared for introducing number portability

It should be introduced in phased manner –

Mobile number portability across the nation amongst all operators

Then fixed number portability

Non implementation of NP will negate the concept of “True market” and operators will go on compromising on service quality standards

What is number portability (NP)?

Number Portability

allows subscriber to change their service provider to one having –

the best service quality

lower tariff options,

& better network coverage

while retaining their old telephone number.

Technological reasons for implementing

Arguments against implementation - India not yet ready as Implementation requires large technological changes;

My Argument why it should be implemented

Our Mobile network is state of the art; technically much better than many countries where MNP is already working

We introduced many services ahead of even developing countries e.g. GPRS

Fixed line NP may have problems; can be sorted and taken up in next stage

If it can work in S Korea – 2004; Greece – 2004; Lithuania – 2005; Belgium – 2000; Honk Kong - 1998

why not in India

Arguments against implementation - India not yet ready as Our tele-density is still much below developed countries; We should concentrate on increasing tele-density; We have enough operators for competition

My Argument why it should be implemented

Mobile nos. in India are largely in Urban areas. Our urban tele-density is ~40.

We added almost 18m mobiles in last 3 months. That means urban teledensity has increased over 6 in last three months.

Requires 12-18 months in implementation after decision. Urban tele-density may cross 50 by then. following table indicate that we will be at par or better than developed countries in terms of tele-density for implementing Number Portability(NP)

For one service say GSM mobile we have maximum 4 operators per service area

Economic reasons

Arguments against implementation - Implementation require huge initial investments, which will outweigh the benefits. Rather we should Concentrate on improving service quality

My Argument why it should be implemented

Its exactly the service quality for which we need NP

Today India has one of the lowest rates for mobile services but quality of service offered is poor

NP eliminates pseudo and psychological barriers to churning thus providing truly competitive market and service quality improvement

Some estimate costs as high as 5000 Cr for implementation which are amplified and incorrect estimate even for implementing full fledged NP across services, operators & Locations

Implement just Mobile NP, then go for fixed line

Call forwarding technology does not requires much costs

Even other technologies for mobile number portability we require central database, routing and query arrangements. It will not cost more than 150 cr to implement.

India has 85m mobile connection now. By 2007 they will be more than 150m. Even if 10% use NP we have 15m users. (Spain 3m used.); International Data Corporation India conducted a survey and found that “30% of mobile subscribers are likely to shift to an operator offering better service, if given the option.” Internationally 10% churning of numbers with NP is common as shown in following figure-

Charge of Just Rs 200 can cover costs. Internationally average charges are around 12-14$.

If consumer is ready to pay for better service and availing better tariffs, why it should not be implemented

Operational reasons

Arguments against implementation - Implementation will have problems of distortions by donor networks

My Argument why it should be implemented

Good planning and proper regulations on following issues can help in smooth operations –

Go for all India implementation

Don’t go for call forwarding option

Locking of handsets to be banned

Address lock in period problems

Costs to be collected and born by recipient networks

Operational problems can always be sorted out in time. After all India is not the first country to implement the NP

Conclusion

The US Supreme Court has directed adoption of number portability and India should also follow. The department of telecommunications (DoT) has set April, 2007 as the deadline for the implementation of mobile phone number portability. The deadline had been recommended by the Telecom Regulatory Authority of India (Trai) and submitted to the DoT in March '06

India is well prepared for introducing number portability

It should be introduced in phased manner –

Mobile number portability across the nation amongst all operators

Then fixed number portability

Non implementation of NP will negate the concept of “True market” and operators will go on compromising on service quality standards

Subscribe to:

Posts (Atom)

Search your favourite topic

3G

(23)

4G

(10)

africa broadband

(2)

African Telecom

(3)

Aircell

(4)

airtel

(20)

Android

(4)

Apple

(6)

Asia Pacific Telecom market

(8)

bharti

(7)

broadband

(39)

Broadcasting

(1)

BSNL

(10)

CDMA

(10)

china mobile

(37)

China Telecom Market

(13)

cross media ownership

(1)

digital divide

(3)

DoCoMo

(3)

DoT

(3)

DTH

(1)

EDGE

(2)

Enterprise Telecom Business

(5)

ericsson

(4)

etisalat

(1)

European Telecom market

(9)

EVDO

(1)

FCC

(2)

fixed line market

(1)

fixed mobile convergence

(2)

forecasts for mobile market

(5)

GTL

(1)

HSPA

(7)

Huawei

(2)

idea

(10)

India 3G

(47)

India CDMA

(50)

India GSM

(60)

India Mobile

(48)

infrastructure sharing

(6)

International Long Distance

(3)

Internet service providers

(3)

Intra Circle Roaming

(1)

Ipad

(1)

IPTV

(5)

ITU

(1)

largetst telecom operator

(6)

latest telecom news

(54)

LG

(2)

LTE

(10)

M-commerce

(4)

Managed networks

(2)

Maxis

(3)

Middle Eastern telecom market

(6)

MIMO

(1)

mobile

(21)

mobile advertising

(2)

Mobile banking

(5)

mobile handsets

(14)

Motorola

(3)

MTNL

(3)

MVNO

(2)

Next Generation Networks

(1)

nokia

(7)

Nokia Siemens

(1)

number portability

(6)

OFDMA

(1)

QUALCOMM

(1)

Reliance Communications

(16)

RIM

(2)

Rural broadband

(1)

rural mobile infrastructure

(9)

Russia

(1)

Samsung

(4)

satellite communications

(1)

Smart Pad

(1)

Smartphone

(3)

Sony Ericsson

(2)

South East Asian Market

(3)

Spectrum

(9)

Spice

(1)

strategy for mobile operators

(63)

Symbian

(1)

Tablet

(3)

Tariff

(1)

Tata Communications

(2)

Tata Teleservices

(5)

TD-SCDMA

(2)

Telcordia

(1)

Tele-density

(4)

telecom equipment

(22)

Telecom growth projections

(13)

Telecom Market India

(57)

telecom market share

(17)

telecom operator strategy

(40)

telecom policy

(32)

Telecom regulation

(7)

telecom sector india

(31)

TRAI

(13)

Unique Identification Authority of India

(1)

US Telecom market

(11)

USO fund

(4)

VAS

(2)

verizon

(6)

Virgin

(1)

Vodafone

(1)

vodafone india

(11)

VoIP

(5)

VSNL

(2)

WAN

(1)

WCDMA

(4)

WiBro

(1)

WiFI

(13)

WiMAX

(20)

wireless broadband

(43)

wireless US

(12)

WMAN

(1)

Yota

(1)

Zain

(1)

ZTE

(2)