Keep pace with the latest and most recent news and updates in telecom, broadcasting and IT sector

Remit money to India through mobile

India is the biggest recipient of overseas remittances in the world at US$25 billion, accounting for around 10% of the world market. The remittances market is growing by 20% in India every year. This programme will enable global Indians to easily and securely send remittances to their dependents, many of whom don't have bank accounts. Intent is to enable individuals access to the benefits of a full range of financial services regardless of socio economic level or geographical location using the ubiquity and ease of mobile communications. The programme will complement existing local remittances channels and make transferring money internationally significantly more affordable.

By 2012 operators will be making $67bn of revenues through SMS?

the growth of SMS revenues will not be as aggressive as the growth of SMS volumes due to declining prices,

SMS continues to be a phenomenal success as the cheapest, quickest and easiest to use form of peer-to-peer mobile communication. Markets have continued to grow and greatly exceeded the predictions of similar research carried out in 2005.

By 2011, the report predicts, mobile instant messaging (MIM), especially in markets such as North America, will supplant SMS as the mainstream messaging service as smartphones and wireless Internet proliferate.

Operators, the report suggests, need to strike a balance between SMS and IM pricing in order to prevent the cannibalisation of SMS revenues in the future.

India now the third largest CDMA market in world

The total CDMA base which accounted for just over a quarter of the total wireless customer count at the end of January stood at 39m customers.

India is now the third largest CDMA market in the world, having overtaken China towards the end of December 2006.

It is estimated that by the beginning of March the size of the Indian CDMA customer base will exceed that of South Korea, which ended 2006 with 40.2m CDMA customers, moving India into second place behind the United States.

Indian wireless market is also expected to go third in the world overall, ahead of Russia. Russia itself broke the 150m barrier in December, but is growing much slower than India - around 2.05m customers per month on average in 2006, versus 5.55m on the sub-continent

By early 2008 India may reach the second place, overtaking the United States which currently occupies the position.

Source - http://www.cellular-news.com

US to reach 50% broadband penetration by year end

While it is good news that broadband penetration is becoming a mainstay in the American home, US still lags behind Denmark, the Netherlands, Iceland, Korea, Switzerland, Finland, Norway, Sweden, Canada, the UK and Belgium in per-capita broadband deployment. The U.S. still lags greatly in the number of fiber connections with just over 500,000 while countries like Japan have 6 million or more.

China Mobile now has 306.10 million customer base

The monthly addition was the largest China Mobile has reported to date.

The carrier said 4.54 million of its new customers in January were prepaid subscribers and 324,000 were contract customers.

The January additions raised China Mobile's total number of subscribers to 306.10 million, from 301.23 million at the end of December.

China Mobile's smaller rival, China Unicom, reportedly added 1.38 million subscribers in January, taking its total number of mobile customers to 143.74 million.

Fixed-mobile convergence - The new kid on the street

ABI Research has found that, by 2011, some 250 million users will be making and receiving phone calls over converged fixed-mobile networks and access points, and the firm expects capital expenditure in fixed-mobile convergence infrastructure to exceed $450 million by 2011. That equates to around 10 percent of households and 8 percent of enterprises using some form of fixed-mobile convergence access point on the premises. This will include UMA and SIP-based solutions, both supporting voice call continuity.

There are several competing technologies for fixed-mobile convergence including use of UMA to aggregate traffic from femtocells and Wi-Fi access points in the home, and picocells in the office. In the longer term, IMS-based solutions will be deployed using SIP to offer rich voice sessions over converged devices.

325 Million subscribers use CDMA2000?

The group also reports more than 100 operators have deployed CDMA2000 in the past three years, including 47 CDMA2000 1xEV-DO networks. As many as 40 of these operators had been GSM carriers.

VoIP - Giants battling for patents

At the same time reports have started spreading through the industry that Vonage is launching an annual pre-paid VoIP plan in a move some theorize is designed to generate some fast cash, and that the VoIP house is also about to become a mobile virtual network operator (MVNO).

Verizon filed its suit in June. In July 2006, Vonage said it had acquired three VoIP-related patents from Digital Packet Licensing that address compression techniques related to the public network, a move seen as an attempt to find technology work-arounds to the Verizon patents if they are upheld.

In the extreme, should Verizon win, then Vonage could theoretically be forced to shut down its VoIP service. Such an outcome, though, could typically take years of litigation, and few industry observers expect that to happen. The most likely outcome is thought to be a license payment from Vonage if it loses, or is losing, the case. Estimates are also that, if it knocks off Vonage, Verizon will then go out after as many other VoIP industry players as it can get its hands on.

Vonage is expected to become a mobile virtual network operator (MVNO).

Vodafone in India - The rough road ahead

Background

Vodafone, already the world's largest cellular carrier, is getting control of India's fourth-largest operator with about 24 million customers and 16.4 percent of the market. Vodafone says its target now is to garner between 20-percent and 25-percent market share by 2012. Assuming all needed regulatory approvals, the deal is expected to close in the second quarter. Hutch-Essar becomes Vodafone's third largest unit, following its German operations and its 45-percent minority stake in Verizon Wireless in the United States. However, the German and U.S. markets are mostly saturated - 80 percent in Germany and 76 percent in the United States - while the Indian market is only 15-percent penetrated, and it's the world's fastest-growing cellular market right now, with a reported 6.5 million new subscribers per month.

The immediate issues

Vodafone's acquisition of Hutchison's share of Hutch-Essar also comes with certain complications that vodafone has to deal with. The first is the Indian law that prohibits foreign entities from holding more than 74 percent of an Indian telecom company. In terms of the foreign-ownership limits, Vodafone reportedly has deals set up to cover that issue as well. Hutchison Telecom had local partners that, between them, hold a 15-percent interest in Hutch-Essar. Those partners have agreed to retain their holdings, Vodafone says, leaving Vodafone's interest at 52 percent after the deal is completed, just enough for it to have full operational control over the operator plus leaving enough leeway for it to buy the 33-percent Essar stake. Vodafone offered to buy out Essar's stake, paying the same price it paid Hutchison. According to Vodafone, if Essar accepts its buyout offer, it already has local minority partners lined up and willing to buy as much as 26 percent of the company.

Vodafone's immediate strategy will focus on -

improving the market performance at Hutch Essar: the Vodafone targets a market share (presumably by revenue) of 25% by FY2012 Rolling out the Voda brand and services Rolling out the network to the 6 circles where there is currently no service.

In the medium to long term, Vodafone will strategise to look at acquiring some of the smaller Indian GSM players to gain market share. Ultimately, the aim must be to be #1 in the market.

Vodafone Group will invest $2 billion in India in the next few years. "I think there will be consolidation in the India market in the near term," Vodafone CEO Mr. Sarin said. "India will be the biggest country for Vodafone in terms of number of subscribers," he said, adding the company will reach a subscriber base of 100 million in the country in the next few years. Sarin didn't specify when he would hit the 100 million target, but said he will achieve faster subscriber growth and a higher subscriber base as a result of roll out in newer circles, or service areas. The companies strategy will be to roll out new services so that the ARPUs increase over next few years (though this remains a very challenging task). The ARPU boost can come from introduction of new services, such as mobile banking in India. On Monday Vodafone announced it would work with Citigroup to develop M-PESA, a mobile phone money transfer application across the world. Sarin pointed out that in many emerging markets - such as India and Africa - mobile phones provide the only way to transact with a bank.

Idea IPO oversubscires 42 times!

The oversubscribtion has given rise to possibilities that the shares immediately will surge by 20 percent or more when they start trading. That's in part based on so-called "grey market" trading in the shares even before the IPO closed, a common practice in Indian share market.

Idea, which has about 12 million subscribers, submitted a "draft red herring prospectus" (DRHP) with the Securities and Exchange Board of India (SEBI) two months ago What everyone is watching now is how the Aditya Birla group, which retains a controlling 65.2-percent equity share in Idea, performs in its plans to build up the carrier. Aditya has said it will use the IPO proceeds to fund expansion plans, including construction of a long-distance network.

Idea first rolled out its network in 1995 in the Indian states of Maharashtra and Gujarat. Since then, it has grown both by bidding for licenses and through buying smaller competitors Escorts and Escotel. Its footprint currently covers nearly 60 percent of India's potential subscriber base, geographically encompassing a vast area with 1,353 towns and cities. That's scheduled to grow to 70 percent within six-to-nine months as the company enters the Bihar and Mumbai markets.

Shapes of things to come - Vodafone & Bharti enter into deal to share backhaul

Vodafone CEO Arun Sarin, in his webcast address on Monday said that infrastructure sharing would enable the UK-based major to save over $1 billion over the next 5 years and also contribute to an addition of 1.5% to its EBITDA margins. In its deal with Bharti, Vodafone has suggested sharing of infrastructure with Bharti. With Bharti and Vodafone having taken the concept of infrastructure sharing to the next level, all eyes are now on the Telecom Regulatory Authority of India. This is because Indian telecom companies are not allowed to share active infrastructure such as optic and feeder fibre cables, radio links, network elements, backhaul, antenna and transmission equipment. At present, Indian telecom companies are permitted to share only passive infrastructure such as towers, repeaters, shelters and generators. But Trai in its upcoming recommendations is likely to suggest that these norms be relaxed.

This concept can translate into big capex and opex savings only if telecom companies are allowed to share both active and passive infrastructure. Trai as well operators feel an extended version of the concept, where radio access networks of operators are shared, can lead to better utilisation of network resources as well as offer increased intra-circle roaming. While passive sharing enables telecom companies to share over 30% in both capex and opex spendings, service providers said that this figure could touch 50% if active infrastructure sharing is allowed.

Active infrastructure sharing will enable operators to provide mobile services to their subscribers wherever their own network signal is not available and help them increase their coverage area and quality of service (QoS) with almost no additional expenditure. Sources also said Trai is examining whether license condition needs to be modified to permit resale of point-to-point bandwidth for limited purpose of backhaul sharing.

Put simply, the savings will not be so significant and Bharti Airtel and Vodafone be able to roll-out joint networks in virgin areas if active infrastructure cannot be shared by operators. Little wonder that Bharti in its communication to Trai on this issue has pointed out that "while, existing license conditions allow passive infrastructure sharing among service providers, however, it has not helped actually translating it into infrastructure sharing to the desirable extent.

Nokia has 79% share of Indian GSM handset market?

Meanwhile in the CDMA market, Nokia again managed to retain its share, while Samsung lost market share from 17 percent to 8 percent, and Motorola too lost market share from 12 percent to 4 percent.LG had 49 percent of the CDMA market vis-à-vis 43 percent in 2005

Is the Indian broadband market falling behind the global trend

Even the residential customers in African countries like Morocco are getting more than 4 Mbps broadband. As the graph below shows already in about 10 countries the residential customers are offered speeds 2 Mbps. (Source ITU report)

High-speed residential Internet access is reaching Africa, with the launch of 2 and 4 Mbps broadband offers in 2006 by the Moroccan ISP Casanet, a 100%-owned subsidiary of Maroc Telecom, through its portal Menara.

Maroc Telecom has just released its annual results for 2006, with around 384,000 ADSL subscribers, the lion's share of Morocco's broadband market. The Moroccan regulator is seeking to partially unbundle the local loop. New entrants such as Meditel and Maroc Connect will be able to use the incumbent's copper cable to offer alternative ADSL services in competition with Maroc Telecom’s offers.

The roll-out of a 4 Mbps offer is just part of the march of higher-speed offers throughout Africa (see graph below).

This analysis is part of the this year's World Information Society Report, to be published on World Information Society Day, 17 May 2007.

Source - The ITU website

The Indian wireless market - Share of different operators (as on 31st Dec 2006)

_hashCode_="603" tabIndexSet="true">

_hashCode_="603" tabIndexSet="true">

Why number portability should be implemented in india

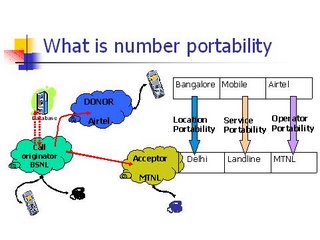

What is number portability (NP)?

Number Portability

allows subscriber to change their service provider to one having –

the best service quality

lower tariff options,

& better network coverage

while retaining their old telephone number.

Technological reasons for implementing

Arguments against implementation - India not yet ready as Implementation requires large technological changes;

My Argument why it should be implemented

Our Mobile network is state of the art; technically much better than many countries where MNP is already working

We introduced many services ahead of even developing countries e.g. GPRS

Fixed line NP may have problems; can be sorted and taken up in next stage

If it can work in S Korea – 2004; Greece – 2004; Lithuania – 2005; Belgium – 2000; Honk Kong - 1998

why not in India

Arguments against implementation - India not yet ready as Our tele-density is still much below developed countries; We should concentrate on increasing tele-density; We have enough operators for competition

My Argument why it should be implemented

Mobile nos. in India are largely in Urban areas. Our urban tele-density is ~40.

We added almost 18m mobiles in last 3 months. That means urban teledensity has increased over 6 in last three months.

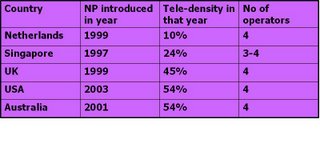

Requires 12-18 months in implementation after decision. Urban tele-density may cross 50 by then. following table indicate that we will be at par or better than developed countries in terms of tele-density for implementing Number Portability(NP)

For one service say GSM mobile we have maximum 4 operators per service area

Economic reasons

Arguments against implementation - Implementation require huge initial investments, which will outweigh the benefits. Rather we should Concentrate on improving service quality

My Argument why it should be implemented

Its exactly the service quality for which we need NP

Today India has one of the lowest rates for mobile services but quality of service offered is poor

NP eliminates pseudo and psychological barriers to churning thus providing truly competitive market and service quality improvement

Some estimate costs as high as 5000 Cr for implementation which are amplified and incorrect estimate even for implementing full fledged NP across services, operators & Locations

Implement just Mobile NP, then go for fixed line

Call forwarding technology does not requires much costs

Even other technologies for mobile number portability we require central database, routing and query arrangements. It will not cost more than 150 cr to implement.

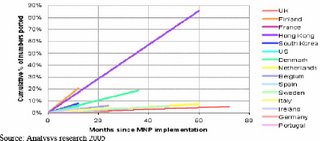

India has 85m mobile connection now. By 2007 they will be more than 150m. Even if 10% use NP we have 15m users. (Spain 3m used.); International Data Corporation India conducted a survey and found that “30% of mobile subscribers are likely to shift to an operator offering better service, if given the option.” Internationally 10% churning of numbers with NP is common as shown in following figure-

Charge of Just Rs 200 can cover costs. Internationally average charges are around 12-14$.

If consumer is ready to pay for better service and availing better tariffs, why it should not be implemented

Operational reasons

Arguments against implementation - Implementation will have problems of distortions by donor networks

My Argument why it should be implemented

Good planning and proper regulations on following issues can help in smooth operations –

Go for all India implementation

Don’t go for call forwarding option

Locking of handsets to be banned

Address lock in period problems

Costs to be collected and born by recipient networks

Operational problems can always be sorted out in time. After all India is not the first country to implement the NP

Conclusion

The US Supreme Court has directed adoption of number portability and India should also follow. The department of telecommunications (DoT) has set April, 2007 as the deadline for the implementation of mobile phone number portability. The deadline had been recommended by the Telecom Regulatory Authority of India (Trai) and submitted to the DoT in March '06

India is well prepared for introducing number portability

It should be introduced in phased manner –

Mobile number portability across the nation amongst all operators

Then fixed number portability

Non implementation of NP will negate the concept of “True market” and operators will go on compromising on service quality standards

Ericsson all set to dominate the wireless broadband market

With some 125 HSPA enabled devices, including some 50 HSPA mobile phone models, Ericsson is today managing networks with more than 100 million subscribers.

THE HUTCH DEAL - WHAT'S THE VODAFONE OFFER

THE DEAL - Vodafone is paying US$11.1 billion for a 67% interest in Hutch Essar, and will assume net debt of approximately US$2.0 billion. The transaction implies an enterprise value of US$18.8 billion for Hutch Essar. HTIL's existing partners, who between them hold a 15% interest in Hutch Essar, have agreed to retain their holdings and become partners with Vodafone. Vodafone's interest will be 52% following completion and Vodafone will exercise full operational control over the business. If Essar decides to accept Vodafone's offer, these local minority partners between them will increase their combined interest in Hutch Essar to 26%.

WHY ? - Constant pressure on Vodafone to enter emerging markets . In the context of a population penetration that is expected to exceed 40% by FY2012, Vodafone is targeting a 20-25% market share in India within the same timeframe. According to Vodafone, India is the fastest growing mobile market in the world, with around 6.5 million new subscribers every month.

BHARTI TO GAIN BY - Vodafone announced that it has signed a memorandum of understanding with Bharti Airtel on infrastructure sharing and that it has granted an option to a Bharti group company to buy its 5.6% direct interest in Bharti.

Whilst Hutch Essar and Bharti will continue to compete independently, Vodafone and Bharti have entered into a MOU relating to a comprehensive range of infrastructure sharing options in India between Hutch Essar and Bharti. Vodafone granted Bharti an option, subject to completion of the Hutch Essar acquisition, to buy its 5.6% listed direct interest in Bharti for US$1.6 billion which compares with the acquisition price of US$0.8 billion.

The Essar Group - currently holds a 33% interest in Hutch Essar and Vodafone will make an offer to buy this stake at the equivalent price per share it has agreed with Hutchison Telecom International.

Vodafone made no comment about whether the network would drop the Hutch branding, and become a Vodafone brand operator in India. The MOU outlines a process for achieving a more extensive level of site sharing and covers both new and existing sites. Around one third of Hutch Essar's current sites are already shared with other Indian mobile operators and Vodafone is planning that around two thirds of total sites will be shared in the longer term.

The plans for future - As part of the operational plan, Vodafone expects to increase capital investment, particularly in the first two to three years, with capex as a percentage of revenues reducing to the low teens by FY2012. The operational plan results in an FY2007-12 EBITDA CAGR percentage around the mid-30s. Cash tax rates of 11-14% for FY2008-12 are expected due to various tax incentives and will trend towards approximately 30-34% in the long term. As a result of this operational plan, the transaction meets Vodafone's stated financial investment criteria, with a ROIC exceeding the local risk adjusted cost of capital in the fifth year and an IRR of around 14%.

5 Gbps transmission rate tested in 4G by DoCoMo

DoCoMo has already tested a maximum speed of 2.5Gbps on December 14, 2005.

The 5 Gbps speed was achieved by increasing the number of MIMO transmitting and receiving antennas from six to 12 each, and by using proprietary received signal processing technology.As compared with the December 14, 2005 test, the frequency spectrum efficiency, or the ratio of data transmission rate to channel bandwidth, was also doubled from 25bps/Hz to 50bps/Hz (5Gbps/100MHz).

The caveate as of now is that the test was done for mobile station moving only at speed fo 10km/h

Does WiMAX has a big future?

The latest study, by Arthur D. Little, compares High Speed Packet Access (HSPA) and WiMAX, and concludes WiMax will capture "at most 15 percent of this network equipment market and perhaps 10 percent of mobile broadband wireless subscribers by 2011-2012."

Other research houses including Strategy Analytics, which recently estimated that WiMAX would win at best 6 percent of the world market by 2010, also have similiar opinions. The findings of study are based on interviews with 31 HSPA and WiMax equipment vendors, operators running the networks, government regulators and financial investors around the globe.

"The momentum in HSDPA deployments has been stimulated by competition from other broadband wireless technologies and by the prospect of competition from mobile WiMax," says Michael Natusch, head of Arthur D. Little's UK TIME (Telecoms, IT, Media and Electronics) practice. "However, there is as yet no convincing real-world evidence of the actual relative performances of these technologies in large scale deployments. Nevertheless, it is likely that these two technologies will achieve comparable levels of performance in typical real-world situations, contrary to the notion that mobile WiMax should be regarded as a 'killer' technology."

In mobile WiMAX's favor, Little in its study does note that "WiMax systems are expected to achieve significantly greater theoretical peak data transfer rates when deployed than today's commercial HSPA networks deliver now." It cites thoretical speeds of 16.8 Mb/s in urban areas compared to 2-3 Mb/s for HSPA. A bigger issue, though, it says is that "the coverage a WiMax base station can achieve, is substantially lower than HSPA, hence HSPA operators will be able to deploy a smaller number of base stations and sites to cover the same geography." The result is that "radio access network Capex for current WiMax technology can significantly exceed HSDPA capex."

That issue may be a WiMAX-killer, because "an HSPA operator will be able to match its growing investment more clearly to the development of demand than mobile WiMax operators who will have to install more cell sites at the beginning to ensure coverage."

Looking further out into the future, and the battle between Mobile WiMAX advocates the HSPA community and its 3G LTE, Little isn't making any solid predictions. "The long term future relative roles of 3G LTE and mobile WiMax, both of which face major development hurdles before they achieve the full promise of new, so-called 4G systems, is uncertain and will be influenced by continuing expected shifts in the priorities and competitive alignments of major players in the wireless industry which has undergone a number of consolidations in recent months," Little concludes.

Source - Telecomweb

265 million wireless users in India by 2010

According to research firm In-Stat, the subcontinent's wireless carriers will continue to rake in profits, even though Average Revenue Per User (ARPU) levels have declined significantly and that downward trend is expected to continue, due to intense competition. The list of rivals includes Bharti Airtel, BSNL, Reliance, Hutchison and Idea Cellular (which is shopping its IPO around . Combined, these players accounted for about 84 percent of the subscriber base in 2005. The company says ARPU in India is one of the lowest in the world and could fall to $5.60 by 2010.

Source - Telecomweb

Future of Wi-Fi in India

Key findings in the paper include:

>>As broadband wireless access grows, the WLAN network gear sector will exceed $275 million by 2012 (not including embedded chips), up from the current $23.1 million.

>>The combined Wi-Fi market (described as consisting of WLAN networking gear, systems integration and professional services but not including embedded devices and laptops) is expected to exceed $744 million by 2012 (CAGR of more than 61 percent).

>>Hybrid Wi-Fi and WiMAX deployments are bringing broadband connectivity to previously unconnected rural and urban areas alike.

>>Dual-mode Wi-Fi /cellular handsets show promise for bringing higher-throughput Internet connectivity to numerous Indian citizens who don't own computers.

New frontiers - Broadband over Power-lines

One of the advantages offered by BPL is that the technology will help stimulate new competitive market dynamics by introducing a new means of broadband access that does not require the building of an entirely new infrastructure.

BPL has been hampered by concerns over interference and the lack of standards necessary to drive it forward. But recent developments point to these problems being resolved. Visiongain believes the questions of BPL-caused RF interference have recently begun to be answered satisfactorily. Further, movements by various global standards bodies promises to boost the market.

The ubiquity of electric power lines as the means of providing access to the Internet is of particular benefit in rural areas, where the biggest promise lies for BPL. But visiongain warns that unless governments are willing to subsidise the substantial infrastructure costs required to enable a BPL system, the technology of providing broadband access over power lines may not be economically viable in these areas.

In urban areas, BPL's timing is critical, because it must compete in a very competitive marketplace, one in which legacy players have not only established a firm foothold, but are beginning to offer triple-play services, giving them differentiation and a competitive advantage. For BPL to succeed, it needs either a significant difference in service or price between BPL and existing broadband methods.

Source electronics.ca publications

WiMAX market picking-up

Source - Marketresearch.com

Multi-billion-dollar investment plans in Indian booming telecom market

Bharti Airtel, India's largest private phone company, invested two billion dollars in the financial year 2006-07 and "plans a similar investment in 2007-2008," mostly targeting rural areas, a Bharti spokesman said.

Ericsson, meanwhile, said it would invest 500 million dollars over the next five years in India -- and possibly more -- to exploit growth in the sector.

top.

"We will be investing 100 million dollars annually for the next five years," Mats Granryd, managing director of Ericsson India, said on the sidelines of a conference in New Delhi.

"The figure could go up depending upon the growth in the sector," he said. "This (market) is growing phenomenally and I do not see an end to it."

The investment announcements came days after the Telecom Regulatory Authority of India said the total number of telephone subscribers in India had hit 189.9 million, of which 149.5 million were mobile customers.

Teledensity -- the number of telephones per 100 people -- rose to 17.16 in December 2006, from 11.43 in the same month in 2005, the agency said.

"There was a steep growth of 50 percent in teledensity in 2006" and "an almost 100 percent increase in teledensity since 2004,"

India added 6.48 million new mobile subscribers in December, making it one of the world's fastest-growing mobile markets.

"India's mobile subscriber base is increasing phenomenally every year -- one customer is added every second"By 2010, India will have more than 500 million mobile subscribers from the current base,"

Indian Telecom Market - Status as on Dec 2006

- 6.48 million Wirless Subscribers added in December 2006.

- Yearly subscribers growth reaches new milestone.

- More than 65 million telephony subscribers added in 2006

The wireless segment added 6.48 million subscribers during

December 2006 as compared to 6.80 million in Nov. 2006. At the end of

December 2006 total wireless (GSM, CDMA and WLL-F) subscribers were

149.50 million.

The wireline subscriber registered a negative growth of 0.08 million

in December 2006 resulting in net addition of 6.40 million subscribers as

compared to 6.75 million during December 2006. The wireline subscriber

base reached 40.43 million at the end of December 2006.

The gross telephony subscribers in country reached 189.93 million

at December 2006 as compared to 183.53 million in November 2006. The

overall tele-density reached 17.16% in December 2006 as compared to

16.60 at the end of November 2006. The tele-density in December 2005

was 11.43 and thus there is steep growth of 50% in tele-density during the

year 2006.

The net addition of wireless and fixed line subscribers in the first

nine months of FY 2006-07 is 49.61 million, which is almost twice as

compared to addition of 26.37 million in the corresponding period of FY

2005-06.

Subscriber Growth in 2006

A comparison of annual additions of subscribers for the previous

two years shows that total additions of subscribers during 2006 is almost

twice the additions in the year 2005 and about thrice that of 2004. There

is an increase of almost 100% in teledensity in two years from 8.62 at the

end of December 2004 to 17.16 at the end of December 2006.

Broadband (> 256 Kbps download) Growth:

Broadband connections have continued growth since beginning of 2006. At

the end of December 2006 total Broadband connections in the country have

reached 2.10 million having addition of 0.1 million during December 2006.

The additions during first nine months of current financial year is 0.75

million as compared to 0.72 millions during the corresponding period in the

previous financial year. The total increase in Broadband subscribers from

January to December 2006 is 1.20 million as compared to addition of 0.85

million during 2005.

BT focuses on M & A

The takeover is BT's 17th acquisition around the world in the past 24 months.

"BT will become the biggest foreign global carrier operating in India today as the result of this deal," BT Global Services CEO Andy Green said in a prepared statement. i2i, a managed service provider, brings a customer base of 200 corporate customers into the BT fold, and it employs more than 200 people.

The price being paid by BT Telecom India, which is a BT joint venture with local Indian company Jubilant Enpro Pvt Ltd., was not disclosed. In a hint, BT said that as of I2i's last audited balance sheet date, March 31 2006, its gross assets were approximately $22.5 million. That suggests a price of not more than, perhaps, $100 million.

While the size of the deal is believed to be relatively small in dollars, "the acquisition of i2i is exciting because it places BT at the heart of the world's fastest-growing IT and business-process outsourcing market," Green said. "This will help BT build a broad-based platform for growth in India and create a single BT-branded channel to the Indian market."

He continued, "India is a cornerstone in our global expansion plans and this investment underlines our commitment to growth from India. BT continues to execute its global mission to be the leader in the delivery of converged networked services."

Indeed, BT recently said it wants $250 million in sales in India by 2008 from its various ventures in the country (TelecomWeb news break, Sept. 14, 2006). It's been coveting an Indian phone license for years (TelecomWeb news break, Nov. 23, 2005) and, in November 2006, BT Telecom India applied for licenses to provide National Long Distance (NLD) and International Long Distance (ILD) services. The BT unit was issued Letters of Intent in December 2006 by India's Department of Telecommunications (DoT), a first step toward the award of licenses. With the acquisition of i2i, it now looks like BT picks up the coveted licenses without further ado. i2i is one of the few companies in India with licenses to provide ILD, NLD, nationwide ISP and Internet telephony services, BT notes.

The acquisition of i2i comes just five days after BT disclosed a deal to buy International Network Services (INS), a Calif.-based provider of IT consulting and software solutions. INS employs almost 900 people in 12 countries worldwide. Again, BT did not disclose financial details but said that, as of the last audited balance sheet on Sept. 25, 2005, the gross assets of INS were $49.7 million. Guesses in the industry are that BT will pay nearly $200 million for the company.

That's a pittance compared with the $3.7 billion that then-Lucent Technologies (these days Alcatel-Lucent) paid for it back in 1999, merging it into Lucent Worldwide Services as the Enhanced Services and Sales division, its enterprise professional services unit. Back then, INS was doing a reported $300 million a year in business, but demand for new network projects collapsed and INS was hit even harder due to the loss of its vendor-agnostic status. Lucent finally sold INS in July 2002, reportedly at a huge loss, creating a privately owned company by venture capitalists.

Source - Telecomweb

IPTV - 3.6 million users worldwide!

That number, admittedly a drop in the buck, has set the stage for what could be explosive growth this year.

Canalys figures the 3.6 million subscribers yielded about $1.3 billion in annualized revenues (TelecomWeb calculates that equates to a reasonable $30 per month on average for an IPTV subscription). It figures about two-thirds of the subscribers in the world last year were in Europe, and that 60 percent of the European market was cornered by just five providers, "but the rush of service launches by new entrants in 2006 means that there are numerous companies with only a few thousand subscribers each."

It listed the top three as PCCW, with an 18.2 percent share; France Telecom, with 16.8 percent; and Free Telecom, at 14 percent. Telefonica and Fastweb round out the top five, but with single-digit market shares.

While Europe has set the IPTV pace so far, the research house predicts that, this year, both North America and the Far East - where only Hong Kong has significant IPTV so far - will begin catching up. "Growth will come from emerging markets such as China and India, following large investments into IPTV deployments there," Canalsys notes. "Australia is also finally moving into the commercial phase of its IPTV offerings, which will lead to fast rollouts of services in 2007."

"North America will be another major growth area, with AT&T and Verizon already pushing nationwide rollouts of IPTV services," it adds - although not making a clear distinction between IPTV and the analog service Verizon is actually offering over FiOS so far.

In a caveat to the IPTV industry, Canalsys warns that "the major threats" for many IPTV service providers will be the quality of their networks and the ability of IPTV systems to scale - an ability that remains unproved.

"IPTV networks will quickly become the most complex and bandwidth-intensive that have ever existed," says Canalys Vice President Alessandra Fitzpatrick. "Many service providers have invested millions of euros on network upgrades, but it remains unproved whether IPTV networks can scale into the millions without performance degrading and response times slowing or even collapsing altogether. Another infrastructure challenge is that service providers will quickly have to learn how to manage multiple billing systems and content across large server farms and storage area networks while maintaining the highest quality of service."

Canalys Senior Analyst Nadia Griffiths also warns IPTV providers that "2007 will see the competitive landscape become even fiercer as IPTV services from established service providers will be challenged by aggressively priced alternatives from Web TV, cable, satellite and content companies. These are all contenders for a share of the limited wallet of most consumers."

Source - Telecomweb

Top games that generate revenues on mobile

Puzzle and strategy titles dominated the best-seller list of mobile games in 1Q06, according to Telephia. Games like “Tetris," ”Tetris Deluxe” and “Bejeweled” accounted for about one-third of all dollars spent on mobile gaming in the quarter. Unit sales of games topped 8.6 million in April, a 60-percent increase since the beginning of the year, the mobile metrics company says.

Puzzle and strategy titles were almost twice as lucrative in their overall revenue share (33.8 percent) as the next biggest revenue grabbers, the similar card and casino category (18.3 percent), with sports and racing (12.9 percent) and action/adventure (12.8 percent) trailing.

Telephia’s figures seem to counter recent arguments within the mobile community that mobile gaming is stagnating. Instead, the company sees the handset gaming market as growing substantially just this year.

1Q06 Top Mobile Games (by revenue share)

| Rank | Title | Publisher | Category | Revenue Share |

| 1 | Tetris | EA Mobile | Puzzle/Strategy | 5.2% |

| 2 | Tetris Deluxe | EA Mobile | Puzzle/Strategy | 3.6% |

| 3 | Bejeweled | EA Mobile | Puzzle/Strategy | 2.6% |

| 4 | Jamdat Mahjong | EA Mobile | Puzzle/Strategy | 2.2% |

| 5 | Ms. Pac Man | Namvo | Classic/Arcade | 2% |

| 6 | Galaga | Namvo | Classic/Arcade | 1.9% |

| 7 | Downtown Texas Hold 'Em | EA Mobile | Card/Casino | 1.8% |

| 8 | Who Wants To Be A Millionaire 2005 | Cosmic Infinity | Trivia/Word | 1.5% |

| 9 | Zuma | Glu Mobile | Puzzle/Strategy | 1.4% |

| 9 | Monopoly Tycoon | Hands-On Mobile | Puzzle/Strategy | 1.4% |

| 9 | Frogger | Konami Mobile | Classic/Arcade | 1.4% |

| 9 | Jamdat Solitaire Deluxe | EA Mobile | Card/Casino | 1.4% |

| 10 | Scrabble | EA Mobile | Trivia/Word | 1.3% |

| 10 | Texas Hold 'Em by Phil Hellmuth | Oasys Mobile | Card/Casino | 1.3% |

Source: Telephia

With more than 72 percent of puzzle-and-strategy game revenue being driven by women, they are now responsible for a whopping 65 percent of mobile game purchases. This approximates the gender split for casual online games, where women also dominate, and it’s a complete flip of the demographics for console games, where as many as 80 percent of gamers are male.

Top revenue generating mobile application

It was more than a little surprised to discover from Telephia’s recent “Mobile Application Report” that Zingy’s MapQuest Mobile is not only the biggest revenue-generating app on handsets, but that it wins in a walk.

Telephia, which uses a sample of billing records and revenues as a metric of application success, found MapQuest Mobile accounts for a staggering 21.9 percent of all revenue generated from mobile applications. Say what? All due respect to Zingy and its good job on this map-and-directions widget, but this app is not that great (really), and it certainly isn’t as strong as Verizon's SuperPages 2.0 (5.3 percent of revenue) or eBay Mobile (4.3 percent)

Top 10 Downloadable Mobile Applications By Total Revenue Share (U.S.)

| Application | Publisher | Revenue Share |

| MapQuest Mobile | Zingy | 21.9% |

| The Weather Channel | Weather Channel | 5.7% |

| Verizon SuperPages 2.0 | Verizon Directories | 5.3% |

| Music Choice | Music Choice | 5.0% |

| Sirius Music | Sirius Satellite Radio | 4.8% |

| Accuweather.com Premium | AccuWeather | 4.4% |

| eBay | Bonfire Media LLC | 4.3% |

| Backup Assistant | FusionOne | 2.8% |

| America's Best Mobile Pix | FunMail | 2.6% |

| Yahoo! Photos | Yahoo! | 2.6% |

| ESPN Bottomline Pro | ESPN | 2.1% |

Source: Telephia Mobile Applications Report (1Q06)

The map/directions content category has a natural advantage in this metric because it’s responsible for nearly 40 percent of all recurring revenue from applications. This is the category people tend to keep and pay for month to month, as opposed to many entertainment-oriented apps responsible for only 12 percent of recurring revenues and almost 30 percent of first-time buyer revenues.

Top Downloadable Mobile Applications

By Repeat Purchase Revenue (U.S.)

| Category Share | Repeat Purchase Revenue Share | First-Time Purchase |

| Maps/Directions | 39.5% | 16.8% |

| Weather | 18.9% | 8.7% |

| Entertainment | 12.0% | 29.9% |

| Sports | 8.9% | 3.9% |

| Personal Organization/Tools | 7.4% | 4.3% |

Source: Telephia

MapQuest is a natural beneficiary of two strong mobile forces: “First, the fundamental need – directions and maps – just fits into mobile really well. Second, MapQuest has a well-known and reliable brand on the regular Internet, which has a spillover effect in making it the go-to place for many on the mobile Web as well.”