More than 500 companies have applied for new telco operating licenses in India. AT&T was one those who applied just before the closing bell for applications.

If AT&T should get the license, it would set the stage for a battle royale between it and Vodafone for a share of the world's fastest-growing cellular market.

AT&T's wireless unit, the former Cingular, is of course already in a death match in the United States with Vodafone because Vodafone owns 40 percent of Verizon Wireless. An extension of that battle to India, where cellular-phone use is growing at an estimated eight million subscribers per month, thus would have the industry worldwide on the edge of its seats.

Just to make things even more interesting, Sistema, the owner of Russia's largest wireless carrier, Mobile TeleSystems (MTS), also has applied for an Indian cellular license. There's also some suspicion that, buried in the pile of 500 applications, are papers from proxies for other Tier One cellular players on the world stage.

While DoT is scratching its head over how to decide which of the applicants should get licenses - it hadn't expected to need a process to sort through hundreds of applications. Planning is said to center around a two-stage procedure, most likely the initially weeding out those whose goal is to get a license simply to resell it, instantly becoming quite rich in the process.

What the flood of applicants wants is what's called a Universal Access Services Licence (UASL). Such a license, though, doesn't come with any spectrum; that will be a separate - and potentially expensive - issue. Indeed, there are said to be more than 20 Indian companies that last year were allowed to buy licenses, but they aren't in the cellular business yet because they haven't gotten any spectrum.

At this point, the Indian authorities haven't said exactly what spectrum they eventually will put on offer, although the widespread expectation is they will be looking at channels for 3G and possibly 4G service offerings.

In an almost identical arrangement, Vodafone is paired with India's Essar Group - having bought the Hutchison Telecommunications International Limited (HTIL) stake in what had been Hutchison-Essar earlier this year (TelecomWeb news break, Feb. 12). Vodafone-Essar, though, already is a licensed cellular carrier in India - with Number Three market share as is Idea, sitting in the sixth spot. In all, there are 13 wireless competitors in the market (10 of them offering GSM, three CDMA and one both), although most do not have licenses and spectrum that cover the entire country.

The list of applicants is known to include at least eight major real-estate firms in India.

Keep pace with the latest and most recent news and updates in telecom, broadcasting and IT sector

New "Tilt" in the enterprise phone segment

BlackBerry , iPhone and now Tilt. AT&T is launching new enterprise segment phone. This has not been one of my favorite topics, but the enthusiasm raised by iphone has forced me to look into the features of new "Tilt". We might soon have them in India (Provided DoT acts fast on new applications for licences)

The new "Tilt" phone from AT&T, that may be available in mear future may become the next enterprise phone that may also fit the bill (unlike ipone).

AT&T says the Tilt is its first Windows Mobile 6 smart device, featuring a slide-out QWERTY keypad, a 3-megapixel camera, 3G data speeds from AT&T's UMTS/HSDPA-based BroadbandConnect network and complete global connectivity.

Windows Mobile 6 Tilt users get "the familiar look and feel of their desktop computers at home or in the office," the carrier says, enabling them to view e-mail in their original rich HTML format with live links to Web and Microsoft Office SharePoint sites. All Windows Mobile 6 devices include Microsoft's Direct Push Technology for e-mail delivery and automatic synchronization of Outlook calendars, tasks and contacts through Microsoft Exchange Server. Especially important to enterprises, Windows Mobile 6 offers important device security and management features, including capability to remotely wipe all data from a device should it be lost or stolen, thus helping to ensure that confidential information remains that way.

In addition to Microsoft Direct Push, the AT&T claims its Tilt will be "the first Windows Mobile device in North America to include BlackBerry Connect v4.0 software, which provides BlackBerry e-mail service, security and device management for IT administrators and the benefit for users of wireless synchronization of e-mail, calendar, contacts, task list and memo pad information." BlackBerry Connect v4.0 supports push e-mail for Microsoft Exchange, IBM Lotus Domino and Novell GroupWise through the BlackBerry Enterprise Server and personal e-mail through the BlackBerry Internet Service.

Customers also can use the Tilt to access personal e-mail through AT&T's Xpress Mail service. By completing five steps, AT&T customers can set up their Xpress Mail accounts and begin getting personal e-mail from most major POP3/IMAP personal e-mail services pushed to their AT&T Tilt at preset intervals. They also can sync their calendars, access contact lists and view attachments.

Designed by HTC, which really has been putting itself out there this year at wireless industry shows, the AT&T Tilt also features a 2.8-inch color screen that slides back to reveal a full QWERTY keyboard, and then it "tilts" up to position the screen for reading or creating e-mail, browsing online, using applications or just playing videos and games. The Tilt supports Bluetooth 2.0, allowing as many as six Bluetooth devices to be connected simultaneously to the device; Bluetooth Stereo also is supported.

In addition, the AT&T Tilt features the latest version of TeleNav GPS Navigator that provides GPS-enabled turn-by-turn voice and on-screen driving or walking directions, colorful 3-D moving maps and traffic delay alerts with one-click rerouting. The new GPS version also includes address sharing that allows users to share their current locations or the location of their favorite businesses with other mobile users. Business users have access to TeleNav Track, a mobile workforce-management solution that includes GPS-enabled tracking, time sheets, wireless forms, navigation, job dispatching and bar-code scanning.

Regarding the mobile enterprise need for speed, with 3G broadband speed connectivity across the globe and tri-band UMTS/HSDPA capabilities, the Tilt can operate in Japan and South Korea along with the more than 135 countries in which AT&T offers UMTS, EDGE or GPRS international data roaming. For voice, AT&T says road warriors can make or receive phone calls in more than 190 countries

In the States, the Tilt can connect to AT&T's BroadbandConnect network in more than 170 major metropolitan areas, and coverage outside of 3G service areas is available via AT&T's EDGE network where available. Wi-Fi connections are supported by the 802.11b and g frequencies, and enterprise users can use the Tilt to link to corporate wireless LANs or home Wi-Fi networks.

The new phone is pretty affordable at $299.99 after rebate; customers are held to a two-year contract. Unlimited monthly data plans for corporate e-mail are $44.99 with a voice contract. Data plans for personal e-mail, begin at $29.99 a month for 20 MB; that price reflects a $5/month discount for voice and requires that an eligible wireless voice plan be activated and maintained on the same device (limited to one discounted price per eligible voice plan, the carrier says). AT&T also offers an international data plan for the Tilt -- 20 MB in nearly 30 countries -- for an additional $24.99 a month. TeleNav GPS Navigator is available for additional monthly charges of $5.99 for 10 trips and $9.99 for unlimited trips. TeleNav Track service plans range from $12.99 to $21.99 for each device.

In a related product announcement across the border, Rogers Wireless in Canada says it is increasing its presence Windows Mobile market with the introduction of the Palm Treo 750 smartphone and the MOTO Q 9h. The carrier also announced a free online Windows Mobile 6 upgrade for the HTC S621. In support, Rogers launched an ad campaign earlier this week raise enterprise awareness about how Windows Mobile-based applications help mobile professionals stay productive while away from the office.

"The Canadian converged mobile device market has experienced tremendous growth over the past few years registering 56 percent year-over-year growth in 2006. This has been fuelled largely by Canadian organizations' need to improve employee effectiveness by helping them access company information," says Eddie Chan, research analyst/Mobile/Personal Computing & Technology at IDC Canada. "The availability of high-speed connectivity, combined with the familiarity of the Windows-based platform in a mobile environment, such as Windows Mobile 6, can help organizations and their employees realize the benefits of a mobile solution."

(The features have been sourced ffrom telecom news break story)

The new "Tilt" phone from AT&T, that may be available in mear future may become the next enterprise phone that may also fit the bill (unlike ipone).

AT&T says the Tilt is its first Windows Mobile 6 smart device, featuring a slide-out QWERTY keypad, a 3-megapixel camera, 3G data speeds from AT&T's UMTS/HSDPA-based BroadbandConnect network and complete global connectivity.

Windows Mobile 6 Tilt users get "the familiar look and feel of their desktop computers at home or in the office," the carrier says, enabling them to view e-mail in their original rich HTML format with live links to Web and Microsoft Office SharePoint sites. All Windows Mobile 6 devices include Microsoft's Direct Push Technology for e-mail delivery and automatic synchronization of Outlook calendars, tasks and contacts through Microsoft Exchange Server. Especially important to enterprises, Windows Mobile 6 offers important device security and management features, including capability to remotely wipe all data from a device should it be lost or stolen, thus helping to ensure that confidential information remains that way.

In addition to Microsoft Direct Push, the AT&T claims its Tilt will be "the first Windows Mobile device in North America to include BlackBerry Connect v4.0 software, which provides BlackBerry e-mail service, security and device management for IT administrators and the benefit for users of wireless synchronization of e-mail, calendar, contacts, task list and memo pad information." BlackBerry Connect v4.0 supports push e-mail for Microsoft Exchange, IBM Lotus Domino and Novell GroupWise through the BlackBerry Enterprise Server and personal e-mail through the BlackBerry Internet Service.

Customers also can use the Tilt to access personal e-mail through AT&T's Xpress Mail service. By completing five steps, AT&T customers can set up their Xpress Mail accounts and begin getting personal e-mail from most major POP3/IMAP personal e-mail services pushed to their AT&T Tilt at preset intervals. They also can sync their calendars, access contact lists and view attachments.

Designed by HTC, which really has been putting itself out there this year at wireless industry shows, the AT&T Tilt also features a 2.8-inch color screen that slides back to reveal a full QWERTY keyboard, and then it "tilts" up to position the screen for reading or creating e-mail, browsing online, using applications or just playing videos and games. The Tilt supports Bluetooth 2.0, allowing as many as six Bluetooth devices to be connected simultaneously to the device; Bluetooth Stereo also is supported.

In addition, the AT&T Tilt features the latest version of TeleNav GPS Navigator that provides GPS-enabled turn-by-turn voice and on-screen driving or walking directions, colorful 3-D moving maps and traffic delay alerts with one-click rerouting. The new GPS version also includes address sharing that allows users to share their current locations or the location of their favorite businesses with other mobile users. Business users have access to TeleNav Track, a mobile workforce-management solution that includes GPS-enabled tracking, time sheets, wireless forms, navigation, job dispatching and bar-code scanning.

Regarding the mobile enterprise need for speed, with 3G broadband speed connectivity across the globe and tri-band UMTS/HSDPA capabilities, the Tilt can operate in Japan and South Korea along with the more than 135 countries in which AT&T offers UMTS, EDGE or GPRS international data roaming. For voice, AT&T says road warriors can make or receive phone calls in more than 190 countries

In the States, the Tilt can connect to AT&T's BroadbandConnect network in more than 170 major metropolitan areas, and coverage outside of 3G service areas is available via AT&T's EDGE network where available. Wi-Fi connections are supported by the 802.11b and g frequencies, and enterprise users can use the Tilt to link to corporate wireless LANs or home Wi-Fi networks.

The new phone is pretty affordable at $299.99 after rebate; customers are held to a two-year contract. Unlimited monthly data plans for corporate e-mail are $44.99 with a voice contract. Data plans for personal e-mail, begin at $29.99 a month for 20 MB; that price reflects a $5/month discount for voice and requires that an eligible wireless voice plan be activated and maintained on the same device (limited to one discounted price per eligible voice plan, the carrier says). AT&T also offers an international data plan for the Tilt -- 20 MB in nearly 30 countries -- for an additional $24.99 a month. TeleNav GPS Navigator is available for additional monthly charges of $5.99 for 10 trips and $9.99 for unlimited trips. TeleNav Track service plans range from $12.99 to $21.99 for each device.

In a related product announcement across the border, Rogers Wireless in Canada says it is increasing its presence Windows Mobile market with the introduction of the Palm Treo 750 smartphone and the MOTO Q 9h. The carrier also announced a free online Windows Mobile 6 upgrade for the HTC S621. In support, Rogers launched an ad campaign earlier this week raise enterprise awareness about how Windows Mobile-based applications help mobile professionals stay productive while away from the office.

"The Canadian converged mobile device market has experienced tremendous growth over the past few years registering 56 percent year-over-year growth in 2006. This has been fuelled largely by Canadian organizations' need to improve employee effectiveness by helping them access company information," says Eddie Chan, research analyst/Mobile/Personal Computing & Technology at IDC Canada. "The availability of high-speed connectivity, combined with the familiarity of the Windows-based platform in a mobile environment, such as Windows Mobile 6, can help organizations and their employees realize the benefits of a mobile solution."

(The features have been sourced ffrom telecom news break story)

Enterprise solutions - AT & T launches 1 Gb/s bandwidth on demand

AT & T's business arm has launched a 1 Gb/s bandwidth on demand offering, as part of its year-old optical mesh offering, for its enterprise and wholesale customers.

The Optical Mesh Services offering lets customers reallocate bandwidth as needed by increasing or decreasing network capacity in what AT&T calls "near real time." It also lets enterprise customers build and self-administer their own SONET networks using the AT & T BusinessDirect customer portal.

AT&T said that the new 1 Gb/s speed is available at 275 locations around the country linked by what it calls its Intelligent Optical Network - a self-healing network with claimed five nines reliability.

A dynamic Layer 1 service helps companies trying to solve the dilemma of build versus buy. An on-demand optical solution with as much needed bandwidth is a compelling solution for mission-critical business applications with zero tolerance for downtime, as well as for business continuity.

The Optical Mesh Services offering lets customers reallocate bandwidth as needed by increasing or decreasing network capacity in what AT&T calls "near real time." It also lets enterprise customers build and self-administer their own SONET networks using the AT & T BusinessDirect customer portal.

AT&T said that the new 1 Gb/s speed is available at 275 locations around the country linked by what it calls its Intelligent Optical Network - a self-healing network with claimed five nines reliability.

A dynamic Layer 1 service helps companies trying to solve the dilemma of build versus buy. An on-demand optical solution with as much needed bandwidth is a compelling solution for mission-critical business applications with zero tolerance for downtime, as well as for business continuity.

Battle won for Wimax - ITU Accepts IEEE 802.16 as a 3G Standard

The IEEE 802.16 has been accepted by the International Telecommunication Union (ITU) as the sixth technology that it has accepted as a 3G wireless standard. The move has caused celebration in both the WiMAX and WiBro communities - both of which are based on 802.16 variations.

WiMAX/WiBro/802.16 join rival technologies W-CDMA, CDMA-2000 and TD -SCDMA in the ITU's IMT-2000 3G spectrum standard.

Technically the ITU has accepted what it has termed "IMT-2000 OFDMA TDD WMAN," a specification "based on a normative reference to IEEE Std 802.16. In other words, IEEE Std 802.16 is now part of the IMT-2000 family. WMAN, is short for "wireless metropolitan area network," which is the real name for 802.16, as set by the IEEE. Put another way, the ITU didn't accept WiMAX. It accepted WMAN. WiMAX, as defined by the WiMAX Forum, is "based upon the harmonized IEEE 802.16/ETSI HiperMAN standard.

South Korea's WiBRO is a mobile form wireless broadband also based on 802.16 and that may even some day be compatible with what's emerging as mobile WiMAX.

Indeed, even Ambassador Richard M. Russell, the U.S. Representative to the World

Qualcomm has fought hard to keep 802.16 away from ITU acceptance whereas Intel has spent a large fortune promoting the technology so that it could break what it sees as Qualcomm's stranglehold on 3G.

One little caveat in the ITU action that at least some observers noted is that what the ITU approved was 802.16 as a Time Division Duplex (TDD) technology. That's fine for the attempt to craft a mobile WiMAX, which is based on TDD. However, the ITU didn't accept 802.16 for use in Frequency Division Duplex (FDD) bands, which account for an estimated 80 percent or more of all the licensed frequencies in the world.

On the other hand, the ITU approval specified OFDMA - Orthogonal Frequency Division Multiple Access - the first time the ITU's done that. Many in the industry believe OFDMA will be a key technology included in the standardization of 4G wireless technology.

WiMAX/WiBro/802.16 join rival technologies W-CDMA, CDMA-2000 and TD -SCDMA in the ITU's IMT-2000 3G spectrum standard.

Technically the ITU has accepted what it has termed "IMT-2000 OFDMA TDD WMAN," a specification "based on a normative reference to IEEE Std 802.16. In other words, IEEE Std 802.16 is now part of the IMT-2000 family. WMAN, is short for "wireless metropolitan area network," which is the real name for 802.16, as set by the IEEE. Put another way, the ITU didn't accept WiMAX. It accepted WMAN. WiMAX, as defined by the WiMAX Forum, is "based upon the harmonized IEEE 802.16/ETSI HiperMAN standard.

South Korea's WiBRO is a mobile form wireless broadband also based on 802.16 and that may even some day be compatible with what's emerging as mobile WiMAX.

Indeed, even Ambassador Richard M. Russell, the U.S. Representative to the World

Qualcomm has fought hard to keep 802.16 away from ITU acceptance whereas Intel has spent a large fortune promoting the technology so that it could break what it sees as Qualcomm's stranglehold on 3G.

One little caveat in the ITU action that at least some observers noted is that what the ITU approved was 802.16 as a Time Division Duplex (TDD) technology. That's fine for the attempt to craft a mobile WiMAX, which is based on TDD. However, the ITU didn't accept 802.16 for use in Frequency Division Duplex (FDD) bands, which account for an estimated 80 percent or more of all the licensed frequencies in the world.

On the other hand, the ITU approval specified OFDMA - Orthogonal Frequency Division Multiple Access - the first time the ITU's done that. Many in the industry believe OFDMA will be a key technology included in the standardization of 4G wireless technology.

New standard for WiMAX unveiled

The CDMA Development Group (CDG) and the Third Generation Partnership Project 2 (3GPP2) has recently released their proposed Ultra Mobile Broadband (UMB) standard, the technology they hope will trump the mobile iterations of IEEE 802.16e-2005 (so-called mobile WiMAX) and Long-Term Evolution (LTE) as the world's eventual 4G standard.

The proposal now needs to undergo final standardization, which backers predict will be a rapid process. In the United States, UMB is scheduled to emerge as Telecommunications Industry Association (TIA) standard TIA-1121.

The UMB proposal is an Orthogonal Frequency Division Multiple Access (OFDMA) solution that uses

- "sophisticated" control and signaling mechanisms;

- radio resource management (RRM);

- adaptive reverse link (RL) interference management; and

- such advanced antenna techniques as Multiple Input Multiple Output (MIMO), Space Division Multiple Access (SDMA) and beamforming.

It supports inter-technology handoffs and seamless operation with existing CDMA2000 1X and 1xEV-DO systems. It claims to be able to deliver both high-capacity voice and broadband data in all environments, including fixed, pedestrian and fully mobile in excess of 300 km/hr. It supports, proponents say, as many as 1,000 simultaneous VoIP users within a single sector, using 20 megahertz of bandwidth. Average latency is 14.3 mSec over-the-air to support VoIP, push-to-talk and other delay-sensitive applications with minimal jitter.

The unveiling of the UMB proposal, an IP-based mobile broadband standard alleged to enable peak download data rates of 288 Mb/s in a 20-megahertz bandwidth, is clearly evidence that a 4G technology potentially four times as fast as mobile WiMAX is almost market-ready. The CDG and 3GPP2 estimate initial commercial availability at the first half of 2009, and they clearly hope to convince carriers looking at 802.16 to instead wait just a little longer what the CDG fancies is a technology that will "leapfrog other wireless broadband technologies to become the leading standard adopted for next generation mobile telecommunications."

And, of course, all the players - including UMB, LTE and the mobile WiMAX camp - are in a death match for designation as the official definition of wireless 4G technology. That definition won't be released until the 2008/09 timeframe, in the form of the International Telecommunication Union's (ITU) IMT-Advanced requirements. However, some folks, like those at research house In-Stat, also think initial implementations of LTE, UMB and 802.16 WiMAX may fall short of throughput and other expectations, with later enhancements or even some type of technology combination actually bringing real 4G to the table But that's not what the corporate backers of each of the technologies really wants (Qualcomm is behind UMB, which it considers a member of the CDMA 2000 family; Ericsson is touting LTE; and Intel has spent uncounted millions singing the glories of WiMAX). Each wants its technology to be "the one" - thus the faster the push to get UMB at least certified as a TIA standard before the ITU acts, the better to compete with the fact there is an IEEE designation for the foundation technology behind what is being called WiMAX (without, interestingly, the official permission of the IEEE).

"It is expected that the UMB specification will be quickly converted into an official global standard by the 3GPP2 organizational partners," the 3GPP2 said in its statement unveiling the final UMB proposal. It also noted that those "organization partners" include the Association of Radio Industries and Businesses (ARIB) in Japan, China Communications Standards Association (CCSA), TIA in North America, the Telecommunications Technology Association (TTA) in South Korea and the Telecommunications Technology Committee (TTC) in Japan.

The proposal now needs to undergo final standardization, which backers predict will be a rapid process. In the United States, UMB is scheduled to emerge as Telecommunications Industry Association (TIA) standard TIA-1121.

The UMB proposal is an Orthogonal Frequency Division Multiple Access (OFDMA) solution that uses

- "sophisticated" control and signaling mechanisms;

- radio resource management (RRM);

- adaptive reverse link (RL) interference management; and

- such advanced antenna techniques as Multiple Input Multiple Output (MIMO), Space Division Multiple Access (SDMA) and beamforming.

It supports inter-technology handoffs and seamless operation with existing CDMA2000 1X and 1xEV-DO systems. It claims to be able to deliver both high-capacity voice and broadband data in all environments, including fixed, pedestrian and fully mobile in excess of 300 km/hr. It supports, proponents say, as many as 1,000 simultaneous VoIP users within a single sector, using 20 megahertz of bandwidth. Average latency is 14.3 mSec over-the-air to support VoIP, push-to-talk and other delay-sensitive applications with minimal jitter.

The unveiling of the UMB proposal, an IP-based mobile broadband standard alleged to enable peak download data rates of 288 Mb/s in a 20-megahertz bandwidth, is clearly evidence that a 4G technology potentially four times as fast as mobile WiMAX is almost market-ready. The CDG and 3GPP2 estimate initial commercial availability at the first half of 2009, and they clearly hope to convince carriers looking at 802.16 to instead wait just a little longer what the CDG fancies is a technology that will "leapfrog other wireless broadband technologies to become the leading standard adopted for next generation mobile telecommunications."

And, of course, all the players - including UMB, LTE and the mobile WiMAX camp - are in a death match for designation as the official definition of wireless 4G technology. That definition won't be released until the 2008/09 timeframe, in the form of the International Telecommunication Union's (ITU) IMT-Advanced requirements. However, some folks, like those at research house In-Stat, also think initial implementations of LTE, UMB and 802.16 WiMAX may fall short of throughput and other expectations, with later enhancements or even some type of technology combination actually bringing real 4G to the table But that's not what the corporate backers of each of the technologies really wants (Qualcomm is behind UMB, which it considers a member of the CDMA 2000 family; Ericsson is touting LTE; and Intel has spent uncounted millions singing the glories of WiMAX). Each wants its technology to be "the one" - thus the faster the push to get UMB at least certified as a TIA standard before the ITU acts, the better to compete with the fact there is an IEEE designation for the foundation technology behind what is being called WiMAX (without, interestingly, the official permission of the IEEE).

"It is expected that the UMB specification will be quickly converted into an official global standard by the 3GPP2 organizational partners," the 3GPP2 said in its statement unveiling the final UMB proposal. It also noted that those "organization partners" include the Association of Radio Industries and Businesses (ARIB) in Japan, China Communications Standards Association (CCSA), TIA in North America, the Telecommunications Technology Association (TTA) in South Korea and the Telecommunications Technology Committee (TTC) in Japan.

Enterprise Segment - The new mantra for Telecom equipment vendors & service providers

Every Vendor in Hardware/software Telecom space is eying at Enterprise segment. The offerings are based on variety of hardware and software platforms. Here are few examples -

- Cisco has recentlyunveiled a new line of hardware and software in its "Empowered Branch" portfolio, building on the offerings it already has that are designed to give branches essentially the same type of service as corporate headquarters.

The latest gear even extends to tiny offices with fewer than 20 workers.

The new offerings include the first "lite" version of Cisco's flagship IOS software, hardware that includes routers and LAN switches, and new support for 802.11n wireless. With the emergence of new business applications and a more collaborative global business environment, Cisco customers are putting a greater emphasis on their remote offices. Cisco Empowered Branch allows them to take advantage of new business opportunities by providing them with a network platform that addresses all their application and service needs today, yet continuously evolves to provide service innovations required for the future.

- The International Association of Managed Service Providers, better known as the MSPAlliance, has launched a Vendor Accreditation Program (VAP) for the managed-services industry and named the first seven vendors certified under that program.

Those first seven are Intel, SilverBack Technologies/Dell, Asigra, Untangle, XRoads Networks, LiveCargo and N-Able Technologies.

The Alliance, which claims membership of some 2,000 managed-service providers (MSPs), already has been accrediting MSPs, but this is the first time it's accredited the suppliers that provide systems and software to those MSPs. The group wants to grow the first seven accredited vendors quickly to a group of at least 50.

- BT Conferencing, the conferencing and collaboration services division of BT, entered into a strategic partnership with the Corporate Executive Board to provide global collaborative services for the next three years to the Board's enterprise clientele.

As part of the agreement, BT Conferencing will provide Corporate Executive Board with managed audio and Web services to its network of more than 14,000 C-suite executives and their staff from more than 3,700 leading global corporations and organizations, including much of the Fortune 500. Implementation of the new service already has begun, and it should be in full swing by the end of the week.

BT Conferencing has offices in the United States, EMEA and Asia Pacific; it specializes in delivering conferencing and collaborative solutions and product hardware to some of the largest companies in the world, and its solutions are designed for enterprises a million minutes or more of conferencing time. The Corporate Executive Board Company provides best-practices research and analysis focusing on corporate strategy, operations and general management issues.

- In North America and Western Europe, large companies will play an increasing role in VoIP adoption, says ABI Research, adding hosted services will be used on a more regular basis as well, becoming a stronger engine for enterprise VoIP growth in the future.

The hosted services market for VoIP applications initially focused on (and found success with) smaller companies, the research firm says. Typically, smaller companies do not have the IT staff or the budget to install their own VoIP systems. As a result, they often rely on service providers for VoIP services that include the type of features found in large-enterprise phone networks. Service providers have not focused on large-enterprise-hosted phone services, but this is likely to change in the future as telecom operators (i.e., the traditional market leaders) face new competition in the smaller-business market from competitive operators, cable operators and other alternative-service providers. ABI Research believes service providers will take their experience with easy-to-serve small companies to adaptively re-size to favor larger companies.

The news from all quarters on enterprise telecom business and solutions are pouring in from all quarters. In India also the market is already estimated to be sized at Rs 10,000 cr pa and is growing fast. The success of telecom operators in this segment will depend not on an early move but on the right move. The one who can mix the right technologies with the best service level agreements will emerge as winner

- Cisco has recentlyunveiled a new line of hardware and software in its "Empowered Branch" portfolio, building on the offerings it already has that are designed to give branches essentially the same type of service as corporate headquarters.

The latest gear even extends to tiny offices with fewer than 20 workers.

The new offerings include the first "lite" version of Cisco's flagship IOS software, hardware that includes routers and LAN switches, and new support for 802.11n wireless. With the emergence of new business applications and a more collaborative global business environment, Cisco customers are putting a greater emphasis on their remote offices. Cisco Empowered Branch allows them to take advantage of new business opportunities by providing them with a network platform that addresses all their application and service needs today, yet continuously evolves to provide service innovations required for the future.

- The International Association of Managed Service Providers, better known as the MSPAlliance, has launched a Vendor Accreditation Program (VAP) for the managed-services industry and named the first seven vendors certified under that program.

Those first seven are Intel, SilverBack Technologies/Dell, Asigra, Untangle, XRoads Networks, LiveCargo and N-Able Technologies.

The Alliance, which claims membership of some 2,000 managed-service providers (MSPs), already has been accrediting MSPs, but this is the first time it's accredited the suppliers that provide systems and software to those MSPs. The group wants to grow the first seven accredited vendors quickly to a group of at least 50.

- BT Conferencing, the conferencing and collaboration services division of BT, entered into a strategic partnership with the Corporate Executive Board to provide global collaborative services for the next three years to the Board's enterprise clientele.

As part of the agreement, BT Conferencing will provide Corporate Executive Board with managed audio and Web services to its network of more than 14,000 C-suite executives and their staff from more than 3,700 leading global corporations and organizations, including much of the Fortune 500. Implementation of the new service already has begun, and it should be in full swing by the end of the week.

BT Conferencing has offices in the United States, EMEA and Asia Pacific; it specializes in delivering conferencing and collaborative solutions and product hardware to some of the largest companies in the world, and its solutions are designed for enterprises a million minutes or more of conferencing time. The Corporate Executive Board Company provides best-practices research and analysis focusing on corporate strategy, operations and general management issues.

- In North America and Western Europe, large companies will play an increasing role in VoIP adoption, says ABI Research, adding hosted services will be used on a more regular basis as well, becoming a stronger engine for enterprise VoIP growth in the future.

The hosted services market for VoIP applications initially focused on (and found success with) smaller companies, the research firm says. Typically, smaller companies do not have the IT staff or the budget to install their own VoIP systems. As a result, they often rely on service providers for VoIP services that include the type of features found in large-enterprise phone networks. Service providers have not focused on large-enterprise-hosted phone services, but this is likely to change in the future as telecom operators (i.e., the traditional market leaders) face new competition in the smaller-business market from competitive operators, cable operators and other alternative-service providers. ABI Research believes service providers will take their experience with easy-to-serve small companies to adaptively re-size to favor larger companies.

The news from all quarters on enterprise telecom business and solutions are pouring in from all quarters. In India also the market is already estimated to be sized at Rs 10,000 cr pa and is growing fast. The success of telecom operators in this segment will depend not on an early move but on the right move. The one who can mix the right technologies with the best service level agreements will emerge as winner

US Treasury to get next-generation enterprise network - Similar large enterprise business opportunities to crop up in India soon

Came across the following news item. My comments are at the end.

AT&T has picked up what could amount to a $1 billion order to build a next-generation enterprise network for the U.S. Treasury. The award is the first of what eventually will be dozens of billions of dollars spent by the U.S. government under the Networx Universal contract, the largest single telecom order in the history of the world, shared by teams led by AT&T, Verizon and Quest.

Under the Treasury order, AT&T and members of its team are to build and transition the Treasury to a next-gen enterprise network known as the Treasury Network (TNet). Technically, the award is for $270 million but, with various add-ons and options, it's expected to hit $1 billion. What the Treasury has ordered is a fully managed network service, coupled with service-level agreements and performance incentives to deliver secure voice, data and video communications.

The Networx contract actually represents a reiteration of a $1 billion, 10-year contract Treasury had awarded AT&T in December 2004. That award was the following year, following protests upheld by the GSA. Initially, it had been thought Treasury would re-bid the contract itself but, as it now turns out, it's now under the Networx umbrella.

In India also many of the state government treasuries have built their networks at the cost of millions of rupees. Govt. of M.P., Karnataka etc have been leaders in this respect. The next wave of upgrading these networks to next -generation manages service networks is expected soon and will be a big business opportunity for Indian Telcos

AT&T has picked up what could amount to a $1 billion order to build a next-generation enterprise network for the U.S. Treasury. The award is the first of what eventually will be dozens of billions of dollars spent by the U.S. government under the Networx Universal contract, the largest single telecom order in the history of the world, shared by teams led by AT&T, Verizon and Quest.

Under the Treasury order, AT&T and members of its team are to build and transition the Treasury to a next-gen enterprise network known as the Treasury Network (TNet). Technically, the award is for $270 million but, with various add-ons and options, it's expected to hit $1 billion. What the Treasury has ordered is a fully managed network service, coupled with service-level agreements and performance incentives to deliver secure voice, data and video communications.

The Networx contract actually represents a reiteration of a $1 billion, 10-year contract Treasury had awarded AT&T in December 2004. That award was the following year, following protests upheld by the GSA. Initially, it had been thought Treasury would re-bid the contract itself but, as it now turns out, it's now under the Networx umbrella.

In India also many of the state government treasuries have built their networks at the cost of millions of rupees. Govt. of M.P., Karnataka etc have been leaders in this respect. The next wave of upgrading these networks to next -generation manages service networks is expected soon and will be a big business opportunity for Indian Telcos

A case for implementing number portability in India

Well friends the debate on implementation of number portability in India is now almost 3 years old. The issue keeps popping up every time TRAI comes out with some statements. Here are the extracts of my arguments in favor of implementing the same. These were presented at a debate at IIM Bangalore. I have covered them in a post earlier , but am repeating them in view of the currency of the issue. I welcome your comments on the same. -

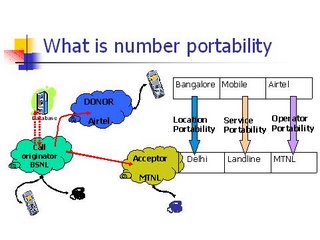

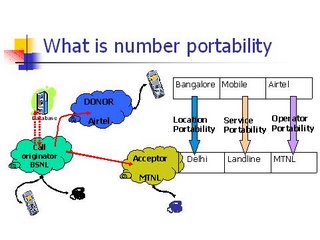

What is number portability (NP)?

Number Portability

allows subscriber to change their service provider to one having –

the best service quality

lower tariff options,

& better network coverage

while retaining their old telephone number.

Technological reasons for implementing

Arguments against implementation - India not yet ready as Implementation requires large technological changes;

My Argument why it should be implemented

Our Mobile network is state of the art; technically much better than many countries where MNP is already working

We introduced many services ahead of even developing countries e.g. GPRS

Fixed line NP may have problems; can be sorted and taken up in next stage

If it can work in S Korea – 2004; Greece – 2004; Lithuania – 2005; Belgium – 2000; Honk Kong - 1998

why not in India

Arguments against implementation - India not yet ready as Our tele-density is still much below developed countries; We should concentrate on increasing tele-density; We have enough operators for competition

My Argument why it should be implemented

Mobile nos. in India are largely in Urban areas. Our urban tele-density is ~40.

We added almost 18m mobiles in last 3 months. That means urban teledensity has increased over 6 in last three months.

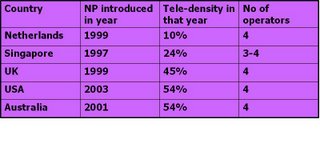

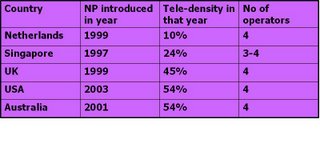

Requires 12-18 months in implementation after decision. Urban tele-density may cross 50 by then. following table indicate that we will be at par or better than developed countries in terms of tele-density for implementing Number Portability(NP)

For one service say GSM mobile we have maximum 4 operators per service area

Economic reasons

Arguments against implementation - Implementation require huge initial investments, which will outweigh the benefits. Rather we should Concentrate on improving service quality

My Argument why it should be implemented

Its exactly the service quality for which we need NP

Today India has one of the lowest rates for mobile services but quality of service offered is poor

NP eliminates pseudo and psychological barriers to churning thus providing truly competitive market and service quality improvement

Some estimate costs as high as 5000 Cr for implementation which are amplified and incorrect estimate even for implementing full fledged NP across services, operators & Locations

Implement just Mobile NP, then go for fixed line

Call forwarding technology does not requires much costs

Even other technologies for mobile number portability we require central database, routing and query arrangements. It will not cost more than 150 cr to implement.

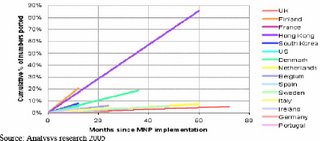

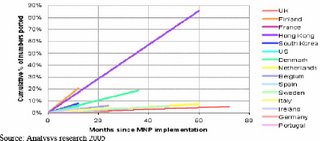

India has 85m mobile connection now. By 2007 they will be more than 150m. Even if 10% use NP we have 15m users. (Spain 3m used.); International Data Corporation India conducted a survey and found that “30% of mobile subscribers are likely to shift to an operator offering better service, if given the option.” Internationally 10% churning of numbers with NP is common as shown in following figure-

Charge of Just Rs 200 can cover costs. Internationally average charges are around 12-14$.

If consumer is ready to pay for better service and availing better tariffs, why it should not be implemented

Operational reasons

Arguments against implementation - Implementation will have problems of distortions by donor networks

My Argument why it should be implemented

Good planning and proper regulations on following issues can help in smooth operations –

Go for all India implementation

Don’t go for call forwarding option

Locking of handsets to be banned

Address lock in period problems

Costs to be collected and born by recipient networks

Operational problems can always be sorted out in time. After all India is not the first country to implement the NP

Conclusion

The US Supreme Court has directed adoption of number portability and India should also follow. The department of telecommunications (DoT) has set April, 2007 as the deadline for the implementation of mobile phone number portability. The deadline had been recommended by the Telecom Regulatory Authority of India (Trai) and submitted to the DoT in March '06

India is well prepared for introducing number portability

It should be introduced in phased manner –

Mobile number portability across the nation amongst all operators

Then fixed number portability

Non implementation of NP will negate the concept of “True market” and operators will go on compromising on service quality standards

What is number portability (NP)?

Number Portability

allows subscriber to change their service provider to one having –

the best service quality

lower tariff options,

& better network coverage

while retaining their old telephone number.

Technological reasons for implementing

Arguments against implementation - India not yet ready as Implementation requires large technological changes;

My Argument why it should be implemented

Our Mobile network is state of the art; technically much better than many countries where MNP is already working

We introduced many services ahead of even developing countries e.g. GPRS

Fixed line NP may have problems; can be sorted and taken up in next stage

If it can work in S Korea – 2004; Greece – 2004; Lithuania – 2005; Belgium – 2000; Honk Kong - 1998

why not in India

Arguments against implementation - India not yet ready as Our tele-density is still much below developed countries; We should concentrate on increasing tele-density; We have enough operators for competition

My Argument why it should be implemented

Mobile nos. in India are largely in Urban areas. Our urban tele-density is ~40.

We added almost 18m mobiles in last 3 months. That means urban teledensity has increased over 6 in last three months.

Requires 12-18 months in implementation after decision. Urban tele-density may cross 50 by then. following table indicate that we will be at par or better than developed countries in terms of tele-density for implementing Number Portability(NP)

For one service say GSM mobile we have maximum 4 operators per service area

Economic reasons

Arguments against implementation - Implementation require huge initial investments, which will outweigh the benefits. Rather we should Concentrate on improving service quality

My Argument why it should be implemented

Its exactly the service quality for which we need NP

Today India has one of the lowest rates for mobile services but quality of service offered is poor

NP eliminates pseudo and psychological barriers to churning thus providing truly competitive market and service quality improvement

Some estimate costs as high as 5000 Cr for implementation which are amplified and incorrect estimate even for implementing full fledged NP across services, operators & Locations

Implement just Mobile NP, then go for fixed line

Call forwarding technology does not requires much costs

Even other technologies for mobile number portability we require central database, routing and query arrangements. It will not cost more than 150 cr to implement.

India has 85m mobile connection now. By 2007 they will be more than 150m. Even if 10% use NP we have 15m users. (Spain 3m used.); International Data Corporation India conducted a survey and found that “30% of mobile subscribers are likely to shift to an operator offering better service, if given the option.” Internationally 10% churning of numbers with NP is common as shown in following figure-

Charge of Just Rs 200 can cover costs. Internationally average charges are around 12-14$.

If consumer is ready to pay for better service and availing better tariffs, why it should not be implemented

Operational reasons

Arguments against implementation - Implementation will have problems of distortions by donor networks

My Argument why it should be implemented

Good planning and proper regulations on following issues can help in smooth operations –

Go for all India implementation

Don’t go for call forwarding option

Locking of handsets to be banned

Address lock in period problems

Costs to be collected and born by recipient networks

Operational problems can always be sorted out in time. After all India is not the first country to implement the NP

Conclusion

The US Supreme Court has directed adoption of number portability and India should also follow. The department of telecommunications (DoT) has set April, 2007 as the deadline for the implementation of mobile phone number portability. The deadline had been recommended by the Telecom Regulatory Authority of India (Trai) and submitted to the DoT in March '06

India is well prepared for introducing number portability

It should be introduced in phased manner –

Mobile number portability across the nation amongst all operators

Then fixed number portability

Non implementation of NP will negate the concept of “True market” and operators will go on compromising on service quality standards

Snapshot picture of CDMA deployment in India

These extracts from report of CDMA Development Group (CDG) gives a good snapshot picture of CDMA deployment in India. I thought the extracts were worth sharing.

"The CDMA arena in India is booming, with that country's CDMA2000 subscriber base now topping 50 million fixed and mobile users. The India's subscriber growth reached this milestone in only five years, half the time it took GSM to reach the same number in the subcontinent. The CDG attributes this rapid growth in the region to the economic delivery of differentiated value-added services, network expansion into the rural areas of India and the growing availability of very-low-end (VLE) devices.

With 2 million net subscriber additions in July, CDMA2000 subscriber base in India reached 51.1 million. Reliance Communications and Tata Teleservices, which the group says are among the Top 20 fastest-growing operators in the world, are investing in the CDMA2000 business to further accelerate this growth rate. CDMA2000 devices have experienced 50 percent year-over-year growth since 2003, with more OEMs participating in CDMA than in GSM.

In addition, the rapid expansion of CDMA2000 networks into rural areas of India to deliver voice and broadband Internet access has been a primary factor in reaching the 50- million-subscriber milestone. India reportedly leads the industry in the introduction of affordable fixed and mobile broadband access to underserved markets. In fact, the CDC says Reliance has launched one of the largest CDMA2000 network expansions on the planet -- with plans to reach more than 20,000 towns and 300,000 villages. In addition, CDMA2000 operators are poised to begin a seamless upgrade of their existing networks EV-DO Rev A.

With trials underway and operators rapidly expanding into the rural areas of the country, EV-DO Rev. A is expected to become an effective platform for enabling affordable broadband Internet access and value-added services in India's rural and urban markets. BSNL has already announced tariff plans for 1X and EV-DO broadband data services, supported by PC cards and USB thumb-drive modems. Tata introduced what it says is India's first 1X USB thumb-drive modem to support its Plug2Surf wireless Internet services, while Reliance recently acquired Yipes Holdings to address the enterprise market. And recent research predicts more than 35 million people will be using mobile broadband services in India by 2010."

CDMA2000 subscriber growth is also being driven by what the CDG says is India's global leadership in the selection and availability of VLE handsets; there reportedly are 45 VLE CDMA2000 devices from 14 suppliers available in country, and that number is expected to increase dramatically with the further availability of single-chipset devices. Another 10 single-chipset VLE handsets are expected to be launched within the next month, and the Indian CDMA industry has plans to support the local production of CDMA2000 devices.

"The CDMA arena in India is booming, with that country's CDMA2000 subscriber base now topping 50 million fixed and mobile users. The India's subscriber growth reached this milestone in only five years, half the time it took GSM to reach the same number in the subcontinent. The CDG attributes this rapid growth in the region to the economic delivery of differentiated value-added services, network expansion into the rural areas of India and the growing availability of very-low-end (VLE) devices.

With 2 million net subscriber additions in July, CDMA2000 subscriber base in India reached 51.1 million. Reliance Communications and Tata Teleservices, which the group says are among the Top 20 fastest-growing operators in the world, are investing in the CDMA2000 business to further accelerate this growth rate. CDMA2000 devices have experienced 50 percent year-over-year growth since 2003, with more OEMs participating in CDMA than in GSM.

In addition, the rapid expansion of CDMA2000 networks into rural areas of India to deliver voice and broadband Internet access has been a primary factor in reaching the 50- million-subscriber milestone. India reportedly leads the industry in the introduction of affordable fixed and mobile broadband access to underserved markets. In fact, the CDC says Reliance has launched one of the largest CDMA2000 network expansions on the planet -- with plans to reach more than 20,000 towns and 300,000 villages. In addition, CDMA2000 operators are poised to begin a seamless upgrade of their existing networks EV-DO Rev A.

With trials underway and operators rapidly expanding into the rural areas of the country, EV-DO Rev. A is expected to become an effective platform for enabling affordable broadband Internet access and value-added services in India's rural and urban markets. BSNL has already announced tariff plans for 1X and EV-DO broadband data services, supported by PC cards and USB thumb-drive modems. Tata introduced what it says is India's first 1X USB thumb-drive modem to support its Plug2Surf wireless Internet services, while Reliance recently acquired Yipes Holdings to address the enterprise market. And recent research predicts more than 35 million people will be using mobile broadband services in India by 2010."

CDMA2000 subscriber growth is also being driven by what the CDG says is India's global leadership in the selection and availability of VLE handsets; there reportedly are 45 VLE CDMA2000 devices from 14 suppliers available in country, and that number is expected to increase dramatically with the further availability of single-chipset devices. Another 10 single-chipset VLE handsets are expected to be launched within the next month, and the Indian CDMA industry has plans to support the local production of CDMA2000 devices.

Mobile VAS revenues in India to touch Rs 8200 Cr by next fiscal !!!

According to an estimate by industry body Assocham, the mobile value added services are poised to grow by over 65 per cent to touch Rs 8,200 crore by the end of this fiscal from Rs 4,950 crore in the last fiscal . The high growth is attributed to a rapidly increasing large subscriber base and easy accessibility to the end-users. Various downloads such as ringtones, bill-related information, contest, exam results and messages received from public services such as banks, railways and airlines earn revenues for the industry. Such revenues will grow and multiply to add volumes to mobile value added services (VAS).

Indian music industry earned more than 35 million dollar from such services which is equivalent to 20 per cent of its total revenue. The total mobile music downloads in Indian markets are valued at 75 million dollars and is expected to grow by 25 per cent in the next year. SMS interactivity, which has become an integral part of most of TV shows, would become a major source of revenue for the channels. TV show Indian Idol on Sony got more than 55 million votes via SMS -- at a rate of Rs 3 per SMS, that is Rs 16.5 crore. The telecom companies earned Rs 11.5 crore and Sony made Rs 5 crore.

Indian music industry earned more than 35 million dollar from such services which is equivalent to 20 per cent of its total revenue. The total mobile music downloads in Indian markets are valued at 75 million dollars and is expected to grow by 25 per cent in the next year. SMS interactivity, which has become an integral part of most of TV shows, would become a major source of revenue for the channels. TV show Indian Idol on Sony got more than 55 million votes via SMS -- at a rate of Rs 3 per SMS, that is Rs 16.5 crore. The telecom companies earned Rs 11.5 crore and Sony made Rs 5 crore.

What should be the limit on market share after M & A in Telecom space ?

TRAI's consultation paper on licensing norms review has attracted following views from major Indian Telcos :

State-owned BSNL has suggested lowering of the market share limit to 40 per cent from the current 67 per cent following the merger and acquisitions of two entities in the telecom sector to avoid monopolistic situation. "It is felt that the existing provision of 67 per cent market share will create non-competitive or monopolistic situation. It is, therefore, suggested that this limit should be brought down to about 40 per cent"

Vodafone Essar, which has recently acquired number two slot in terms of subscriber base, said "We are of the opinion that the 67 per cent limit is appropriate when applied to a narrow mobile market definition. "But regime of the current M&A Guidelines, not a single intra-circle merger between licensees has taken place to date and it cannot be said that the current guidelines have produced an environment of undue consolidation. The guidelines, therefore, remain appropriate."

CDMA player Tata Teleservices wants this cap to be at 45 per cent. "We recommend a maximum market share of 45 per cent for the merged entity," the company said. The PSU also wants fixing a maximum spectrum limit that would be held by a merged entity be. It also does not want any merger to be allowed between a CDMA and a GSM company. Vodafone Essar said the merged entity should have a spectrum limit.

State-owned BSNL has suggested lowering of the market share limit to 40 per cent from the current 67 per cent following the merger and acquisitions of two entities in the telecom sector to avoid monopolistic situation. "It is felt that the existing provision of 67 per cent market share will create non-competitive or monopolistic situation. It is, therefore, suggested that this limit should be brought down to about 40 per cent"

Vodafone Essar, which has recently acquired number two slot in terms of subscriber base, said "We are of the opinion that the 67 per cent limit is appropriate when applied to a narrow mobile market definition. "But regime of the current M&A Guidelines, not a single intra-circle merger between licensees has taken place to date and it cannot be said that the current guidelines have produced an environment of undue consolidation. The guidelines, therefore, remain appropriate."

CDMA player Tata Teleservices wants this cap to be at 45 per cent. "We recommend a maximum market share of 45 per cent for the merged entity," the company said. The PSU also wants fixing a maximum spectrum limit that would be held by a merged entity be. It also does not want any merger to be allowed between a CDMA and a GSM company. Vodafone Essar said the merged entity should have a spectrum limit.

GSM players in India add 5.4 m subscribers in June 07

GSM players in India added 5.4 million new subscribers in June. the public sector BSNL has registered negative growth in five of the 21 telecom circles where it offers services. Overall, the PSU has added just 4.3 lakh new subscribers in June compared to 1.96 million by Bharti Airtel and 1.54 million by Vodafone-Essar. This also implies that the PSU, which had lost its position as the second largest GSM player in the country to Vodafone Essar in May 2007, has slipped further down. Vodafone Essar now has a total of over 30.75 million subscribers and a market share of 22.61% when compared to 28.42 million and 20.90% for the PSU.

As per the latest data compiled by the Cellular Operators Association of India (COAI), the industry association representing all GSM operators, the GSM subscriber base has touched 136 million as of June end, 2007, up 4.12% when compared to 130.1 million in May 2007. The growth witnessed in June was lead by Bharti Airtel, which added just under two million new users taking its subscriber base to 42.7 million. Bharti now commands a market share of 31.40% in the GSM space. Reliance Telecom, the GSM arm of Reliance Communications has also performed poorly — the company, which has 4.34 million subscribers, has failed to show even a single new addition in all the eight circles it operates. BSNL’s subscriber additions over the last couple of months have been thrown off target as the company has exhausted its capacity in most key circles. The PSU has not undertaken any major expansion contract since October 2005.

This has witnessed even regional players like Idea Cellular which has operations in just 11 circles and Aircel Cellular which has operations in 9 circles overtaking the PSU in terms of subscriber addition over the last couple of months. While BSNL has issued tenders for the supply of over 45 million lines in March 2006, it was so far been unable to place orders for the network equipment. In fact, Idea has added about 0.9 million subscribers last month, which is twice that of BSNL. Last month, among all circles, Category B circles witnessed the highest rate of growth at nearly 5.0%. Within the Category B circles, the highest growth was recorded by the UP (West) Circle at (6.5%) closely followed by West Bengal and Andaman & Nicobar Circle at (6.1%).

As per the latest data compiled by the Cellular Operators Association of India (COAI), the industry association representing all GSM operators, the GSM subscriber base has touched 136 million as of June end, 2007, up 4.12% when compared to 130.1 million in May 2007. The growth witnessed in June was lead by Bharti Airtel, which added just under two million new users taking its subscriber base to 42.7 million. Bharti now commands a market share of 31.40% in the GSM space. Reliance Telecom, the GSM arm of Reliance Communications has also performed poorly — the company, which has 4.34 million subscribers, has failed to show even a single new addition in all the eight circles it operates. BSNL’s subscriber additions over the last couple of months have been thrown off target as the company has exhausted its capacity in most key circles. The PSU has not undertaken any major expansion contract since October 2005.

This has witnessed even regional players like Idea Cellular which has operations in just 11 circles and Aircel Cellular which has operations in 9 circles overtaking the PSU in terms of subscriber addition over the last couple of months. While BSNL has issued tenders for the supply of over 45 million lines in March 2006, it was so far been unable to place orders for the network equipment. In fact, Idea has added about 0.9 million subscribers last month, which is twice that of BSNL. Last month, among all circles, Category B circles witnessed the highest rate of growth at nearly 5.0%. Within the Category B circles, the highest growth was recorded by the UP (West) Circle at (6.5%) closely followed by West Bengal and Andaman & Nicobar Circle at (6.1%).

Reliance awards US $ 200 m contract to Huawei

India's Reliance Communications has announced the award of a network expansion contract, worth over US$200 million, to Huawei Technologies. Under the agreement, Huawei will supply and provide services for CDMA & GSM base stations, including BSC (Base Station Controller) and switches, and help to create first class all-IP Next Generation Network infrastructure.

Earlier in first week of July , Reliance awarded a similar contract worth US$400 million to Alcatel-Lucent

Earlier in first week of July , Reliance awarded a similar contract worth US$400 million to Alcatel-Lucent

WCDMA HSPA connections to reach 40m by 2008 !

As per Wireless Intelligence, WCDMA HSPA cellular connections are expected to reach 40 million worldwide by end of 2008. By 2010, WCDMA HSPA is expected to represent around 45% of total WCDMA cellular connections, which are also on track to exceed GSM connections by 2010 in those countries where the network has been launched.

Asia-Pacific is driving growth during the initial phase of adoption, while European operators will boost total WCDMA HSPA cellular connections from the end of 2008. WCDMA HSPA is expected to increase data traffic and non-voice revenues.

WCDMA HSPA will be commercially present in more than 60 countries by the end of next year, based on announced plans. With the aim of bringing broadband speeds to mobile networks, WCDMA HSPA is a software upgrade to existing WCDMA networks typically launched from 2003. WCDMA HSPA will go through a slow adoption phase until the end of 2008. WCDMA HSPA is expected to represent around 6% of total WCDMA connections by the end of 2007 (11 million connections).

"The fastest early growth is coming from Asia-Pacific, with operators such as KTF, Telstra and NTT DoCoMo already very aggressive in migrating their installed base to the new technology," says Gillet. At an operator group level, Vodafone Group could reach 4.5 million WCDMA HSPA cellular connections by the end of next year. T-Mobile has been focusing more on its EDGE network and is expected to be more aggressive in launching WCDMA HSPA, especially in Germany, its home market. Orange and Telefonica O2 are following the same pattern as they expand coverage in their key markets, including Eastern European countries such as Poland and Czech Republic. Finally, from 2009, WCDMA HSPA uptake in Western and Eastern European countries will trigger a fast adoption of the technology worldwide. "In 2010, worldwide WCDMA HSPA cellular connections are expected to represent around 45% of total WCDMA connections, numbering around 278 million cellular connections.

Handset launches - In 2006, operators were offering high-speed services mainly through HSDPA datacards. HSUPA datacards are expected to be introduced in the second half of 2007. HSDPA handsets will be more affordable from 2008, driving volume.

Handset pricing - As WCDMA moves towards the sub-€100 ASP segment, HSDPA benefits from time and volume advantages and is expected to hit the mid tier by the end of 2008. WCDMA HSPA handsets will hit the mass market faster than the existing WCDMA handsets.

Tariffs - Operators will differentiate by offering new services based on flat-rate tariff plans withWCDMA HSPA as one of the enablers.

Network cost of development - WCDMA HSPA is a software upgrade to the existing WCDMA network infrastructure and is therefore not particularly costly except for backhaul.

Network coverage - WCDMA HSPA will generally be implemented over the whole WCDMA network of an operator, starting with the most densely populated zones.

Technology migration - We have assumed that WCDMA to WCDMA HSPA migration will follow a similar pattern to migration from CDMA2000 1X to CDMA2000 1XEV-DO.

Exceptions - Networks in China and India have not been included in the WCDMA HSPA forecasts as operators have not yet announced any official deployment. Similarly, Russian WCDMA HSPA connections have not yet been forecasted.

Source - http://www.cellular-news.com/

Asia-Pacific is driving growth during the initial phase of adoption, while European operators will boost total WCDMA HSPA cellular connections from the end of 2008. WCDMA HSPA is expected to increase data traffic and non-voice revenues.

WCDMA HSPA will be commercially present in more than 60 countries by the end of next year, based on announced plans. With the aim of bringing broadband speeds to mobile networks, WCDMA HSPA is a software upgrade to existing WCDMA networks typically launched from 2003. WCDMA HSPA will go through a slow adoption phase until the end of 2008. WCDMA HSPA is expected to represent around 6% of total WCDMA connections by the end of 2007 (11 million connections).

"The fastest early growth is coming from Asia-Pacific, with operators such as KTF, Telstra and NTT DoCoMo already very aggressive in migrating their installed base to the new technology," says Gillet. At an operator group level, Vodafone Group could reach 4.5 million WCDMA HSPA cellular connections by the end of next year. T-Mobile has been focusing more on its EDGE network and is expected to be more aggressive in launching WCDMA HSPA, especially in Germany, its home market. Orange and Telefonica O2 are following the same pattern as they expand coverage in their key markets, including Eastern European countries such as Poland and Czech Republic. Finally, from 2009, WCDMA HSPA uptake in Western and Eastern European countries will trigger a fast adoption of the technology worldwide. "In 2010, worldwide WCDMA HSPA cellular connections are expected to represent around 45% of total WCDMA connections, numbering around 278 million cellular connections.

Handset launches - In 2006, operators were offering high-speed services mainly through HSDPA datacards. HSUPA datacards are expected to be introduced in the second half of 2007. HSDPA handsets will be more affordable from 2008, driving volume.

Handset pricing - As WCDMA moves towards the sub-€100 ASP segment, HSDPA benefits from time and volume advantages and is expected to hit the mid tier by the end of 2008. WCDMA HSPA handsets will hit the mass market faster than the existing WCDMA handsets.

Tariffs - Operators will differentiate by offering new services based on flat-rate tariff plans withWCDMA HSPA as one of the enablers.

Network cost of development - WCDMA HSPA is a software upgrade to the existing WCDMA network infrastructure and is therefore not particularly costly except for backhaul.

Network coverage - WCDMA HSPA will generally be implemented over the whole WCDMA network of an operator, starting with the most densely populated zones.

Technology migration - We have assumed that WCDMA to WCDMA HSPA migration will follow a similar pattern to migration from CDMA2000 1X to CDMA2000 1XEV-DO.

Exceptions - Networks in China and India have not been included in the WCDMA HSPA forecasts as operators have not yet announced any official deployment. Similarly, Russian WCDMA HSPA connections have not yet been forecasted.

Source - http://www.cellular-news.com/

ZTE overtake LG to become largest CDMA handset supplier to Indian market

China's ZTE is reported to have overtaken Korea's LG Electronics to become the largest supplier of CDMA handsets to the Indian mobile phone market. The handset manufacturer now has a 26% market share according to market sources cited by the DigiTimes news publication.

ZTE originally entered the Indian market through an agreement with Tata Telecom in 2005 and now includes BSNL and the dominant CDMA operator, Reliance Communications as its customers.

ZTE is reported to have shipped some 15 million handsets in 2006, but had already passed that landmark by the beginning of June this year. The company is expected to ship something like 40 million handsets in total this year.

ZTE originally entered the Indian market through an agreement with Tata Telecom in 2005 and now includes BSNL and the dominant CDMA operator, Reliance Communications as its customers.

ZTE is reported to have shipped some 15 million handsets in 2006, but had already passed that landmark by the beginning of June this year. The company is expected to ship something like 40 million handsets in total this year.

"Fund transfer market using mobile to grow to $8 billion by 2012" - New opportunity for Telcos

According to ABI Research, The market for mobile fund transfers will grow to a revenue opportunity of nearly $8 billion for wireless carriers by 2012, up from some $10 million last year.

By enabling subscribers to send and receive money using their wireless phones, wireless carriers have the opportunity to bring local banking services to millions of people around the world. Such services also could deliver a valuable new revenue stream. Mobile networks offer a number of advantages over existing fund transfer offerings, but most convincing is the high level of adoption and reach of wireless services both geographically and demographically. However, wireless carriers can't do this alone. The need for a banking license to offer such services in most countries means carriers must partner with established banking institutions. Partnerships are encouraged by offering services institutions an effective way to reach new as well as existing customers. ABI Research believes these partnerships, once forged between operators and the financial sector to target mobile fund transfers, also will provide a foundation for a host of additional joint offerings. Meanwhile, startups focused on delivering mobile fund transfers to mobile subscribers also have emerged to drive mobile fund transfer adoption. In one of my earlier postings - "Banks and Telcos - Partnerships of future", I have actually stressed on the same

While enabling national and even localized fund transfers delivers a good business case for operators, ABI says it is in the realm of international payments or remittances that the bulk of the market opportunity lays. Large sums already flow from workers who move overseas but send payments back to family members and friends in their home countries. Targeting these transactions, several wireless carriers and international financial institutions already are offering or developing an international capability for mobile fund transfers.

Another study by Juniper Research predicts that P2P fund transfers and mobile payments in the developing world, together with the commercialization in 2009 of NFC (Near Field Communications) based mPayments will generate transactions worth approximately $22bn and Mobile Payments to be Adopted by 204 Million Mobile Phone Users

By enabling subscribers to send and receive money using their wireless phones, wireless carriers have the opportunity to bring local banking services to millions of people around the world. Such services also could deliver a valuable new revenue stream. Mobile networks offer a number of advantages over existing fund transfer offerings, but most convincing is the high level of adoption and reach of wireless services both geographically and demographically. However, wireless carriers can't do this alone. The need for a banking license to offer such services in most countries means carriers must partner with established banking institutions. Partnerships are encouraged by offering services institutions an effective way to reach new as well as existing customers. ABI Research believes these partnerships, once forged between operators and the financial sector to target mobile fund transfers, also will provide a foundation for a host of additional joint offerings. Meanwhile, startups focused on delivering mobile fund transfers to mobile subscribers also have emerged to drive mobile fund transfer adoption. In one of my earlier postings - "Banks and Telcos - Partnerships of future", I have actually stressed on the same

While enabling national and even localized fund transfers delivers a good business case for operators, ABI says it is in the realm of international payments or remittances that the bulk of the market opportunity lays. Large sums already flow from workers who move overseas but send payments back to family members and friends in their home countries. Targeting these transactions, several wireless carriers and international financial institutions already are offering or developing an international capability for mobile fund transfers.

Another study by Juniper Research predicts that P2P fund transfers and mobile payments in the developing world, together with the commercialization in 2009 of NFC (Near Field Communications) based mPayments will generate transactions worth approximately $22bn and Mobile Payments to be Adopted by 204 Million Mobile Phone Users

"Customers increasingly want telecom services and products to be bundled" - says study on US market

The J.D. Power and Associates 2007 Residential Regional Telephone Customer Satisfaction Study says cable companies, which for the first time lead the customer-satisfaction rankings for telephone service in all six U.S. regions, are proving to be tough competition, mostly due to the rise of triple-play bundles.

The study is based on responses collected in April and May from 11,911 customers nationwide who receive their local and long-distance telephone service from one provider. J.D. Power looked at six factors are examined in determining overall satisfaction: performance and reliability, customer service, billing, image, cost of service, and offerings and promotions.

The study says 86 percent of cable-based voice subscribers also subscribe to data services from the same provider--up from 71 percent in 2006. Conversely, 36 percent of telecom-based voice subscribers also use their providers to fulfill their data needs, an increase of 7 percentage points year over year. The impact of bundling is further evidenced by the boost in importance weight of the offerings and promotions factor, which has increased by 3 percent since the 2006 study.